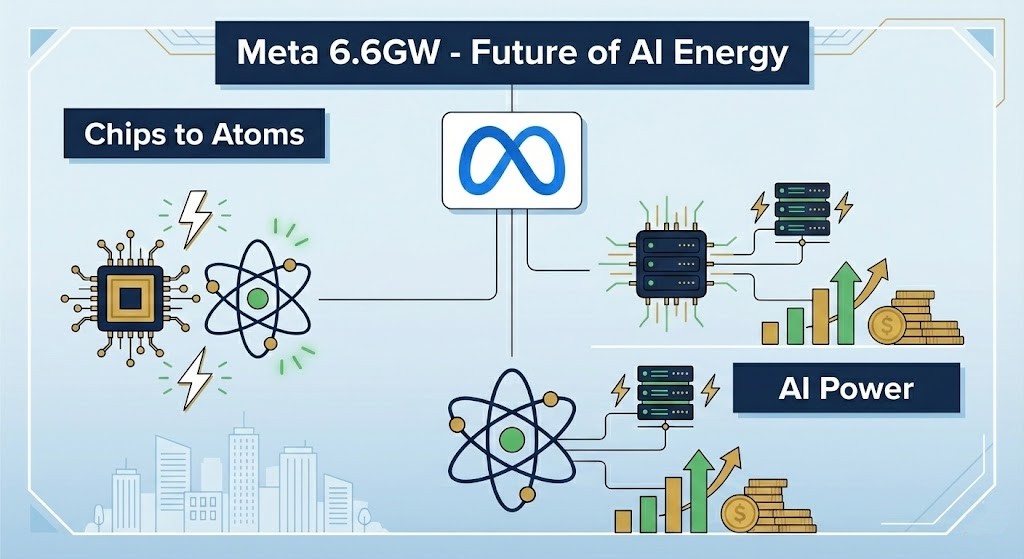

Imagine sitting in a coffee shop in San Francisco, overhearing two venture capitalists discuss not the latest semiconductor chip, but gigawatts of electricity. This is the reality for investors like Mark, a 45-year-old senior software architect who realized his portfolio was too heavy on Nvidia and Microsoft. He watched as Meta Platforms dropped a bombshell on January 9, 2026: a massive 6.6-gigawatt nuclear energy deal involving Vistra Corp and Oklo Inc. This isn’t just an environmental pledge; it is a desperate scramble for baseload power to keep AI data centers running. As the AI war shifts from “Chips” to “Atoms,” investors must understand how to position themselves in this new energy supercycle. We analyze why Meta chose these specific partners and how you can profit from the nuclear renaissance.

1. The Strategic Shift from Chips to Energy Infrastructure

The announcement that Meta has signed agreements for up to 6.6 gigawatts (GW) of nuclear power marks a definitive turning point in the AI narrative. To put this into perspective, 6.6 GW is roughly equivalent to the power output required for 5 million average homes. For years, the market focused solely on who could build the fastest GPU. Now, the bottleneck has moved to who can plug those GPUs into a reliable power source.

1.1 Why Meta Chose Nuclear Over Renewables

Meta’s decision to partner with Vistra, Oklo, and TerraPower highlights a critical limitation of solar and wind energy: intermittency. AI data centers require 24/7 uninterrupted power (baseload power). Batteries can store solar energy, but the cost and scale required for gigawatt-level data centers are currently prohibitive. Nuclear energy offers the only carbon-free solution that operates continuously. By securing this power now, Meta is effectively hedging against future energy inflation and grid congestion.

1.2 The Structure of the 6.6GW Deal

The deal is split into two distinct timelines. First, the immediate utilization of existing nuclear capacity through Vistra Corp, which allows Meta to power its data centers in the near term. Second, a long-term bet on Advanced Nuclear and Small Modular Reactors (SMRs) through partnerships with Oklo and TerraPower. This hybrid approach mitigates risk: Vistra provides certainty, while Oklo provides scalability for the next decade.

| Deal Component | Partner Company | Capacity / Scope | Strategic Value for Investor |

|---|---|---|---|

| Existing Infrastructure | Vistra Corp (VST) | ~2.1 GW (Beaver Valley, etc.) | Immediate revenue impact, 20-year license extension funded by Meta. |

| Future Tech (SMR) | Oklo Inc (OKLO) | ~1.2 GW (Ohio Campus) | High growth potential, validation of SMR tech, commercial deployment by 2030. |

| Next-Gen Reactor | TerraPower (Private) | ~2.8 GW (Natrium) | Demonstrates long-term commitment to non-light water reactor technology. |

2. Vistra Corp (VST): The Immediate Beneficiary of Legacy Assets

Vistra Corp has transformed from a traditional utility into a critical AI infrastructure play. The market realized that building new nuclear plants takes over a decade, making existing licensed plants incredibly valuable assets. Vistra’s stock price, currently hovering around $166.37, reflects this premium.

2.1 Financial Impact of the PPA

The Power Purchase Agreement (PPA) with Meta is unique because it likely includes capital support for extending the life of Vistra’s nuclear fleet, specifically units like Beaver Valley and Perry. This reduces Vistra’s capital expenditure (Capex) burden while guaranteeing a buyer for its power at a premium to wholesale market rates. This structure significantly improves Vistra’s Free Cash Flow (FCF) visibility for the next 20 years.

2.2 Valuation and Market Position

Despite the recent rally, Vistra trades at a valuation that suggests the market is still digesting the full longevity of these cash flows. Unlike tech stocks trading at 50x earnings, Vistra offers a tangible infrastructure valuation. The key metric to watch is the spread between their generation cost and the PPA price. With the Meta deal, this spread is locked in, insulating Vistra from fluctuating natural gas prices.

| Metric | Vistra Corp (VST) | Competitor: Constellation (CEG) | Implication |

|---|---|---|---|

| Stock Price (Jan 12, 2026) | $166.37 | High Correlation | VST offers similar upside to CEG’s Microsoft deal but with broader capacity. |

| Revenue Model | Merchant Power + PPA | Heavily PPA Focused | VST is pivoting to long-term stability similar to CEG. |

| Dividend Yield | ~1.2% | ~0.8% | VST offers slightly better income while waiting for capital appreciation. |

3. Oklo Inc (OKLO): High Risk and High Reward in SMRs

Oklo represents the venture capital side of the nuclear equation. With a stock price of $105.32 and a market cap exceeding $16 billion, Oklo is trading purely on future execution. The partnership with Meta validates its business model, but significant risks remain.

3.1 The “Pre-Revenue” Reality vs. Market Cap

It is crucial to understand that Oklo currently generates zero commercial revenue. The valuation is driven by the scarcity of pure-play SMR stocks and the backing of Sam Altman. The Meta deal provides Oklo with something more valuable than immediate cash: a bankable counterparty. This allows Oklo to secure financing for construction without diluting shareholders excessively. However, the first reactor is not expected to come online until roughly 2030.

3.2 Regulatory Hurdles and Technology

Unlike Vistra’s traditional reactors, Oklo uses liquid metal fast reactor technology. This design recycles fuel and is passively safe, but it has faced scrutiny from the Nuclear Regulatory Commission (NRC). While they have made progress, any regulatory delay could be catastrophic for the stock price. Investors should view Oklo as a technology startup rather than a utility company.

| Scenario | Bull Case (Best) | Bear Case (Worst) | Investment Tactic |

|---|---|---|---|

| Regulatory Approval | NRC fast-tracks design; construction starts 2026. | NRC demands major redesigns; delays beyond 2030. | Monitor NRC docket updates closely. |

| Meta Partnership | Expands to 5GW+; Meta funds initial capex. | Meta cancels due to delays; switches to gas. | Watch for “Notice to Proceed” announcements. |

| Stock Price | Surpasses $200 on construction milestones. | Drops below $50 on dilution or delay news. | Use position sizing to manage volatility (max 5% of portfolio). |

4. Portfolio Strategy and Uranium Supply Chain Analysis

Betting on the winner of the reactor race is difficult. A safer, complementary strategy is to invest in the fuel that all these reactors need: Uranium. The supply-demand imbalance in the uranium market provides a hedge against individual project failures.

4.1 The Uranium Thesis (Cameco and ETFs)

Whether Vistra extends its plant life or Oklo builds new ones, demand for uranium (U3O8) will rise. Cameco (CCJ) is the premier western supplier. As contract volumes increase to fuel these 6.6 GW commitments, long-term uranium contract prices are expected to hold firm above $90/lb. ETFs like Global X Uranium (URA) offer diversified exposure to miners and physical holders.

4.2 Final Action Plan for Investors

For the conservative investor, an allocation to Vistra (VST) and Cameco (CCJ) provides exposure to the theme with backed assets. For the aggressive investor, a smaller, speculative position in Oklo (OKLO) offers leverage to the SMR breakout. Do not chase green candles; look for pullbacks in VST below $160 or OKLO below $100 to build positions.

References

- Vistra Corp & Meta Platforms, “Vistra and Meta Announce Agreements for Nuclear Energy,” PR Newswire, 2026.

- ESG Today, “Meta Unveils Nuclear Power Partnerships for AI Data Centers,” 2026.

- Bloomberg, “Meta Signs Multi-Gigawatt Nuclear Deals,” 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. The stock prices mentioned (VST $166.37, OKLO $105.32) are as of January 12, 2026, and may fluctuate. Please consult with a certified financial advisor before making any investment decisions.