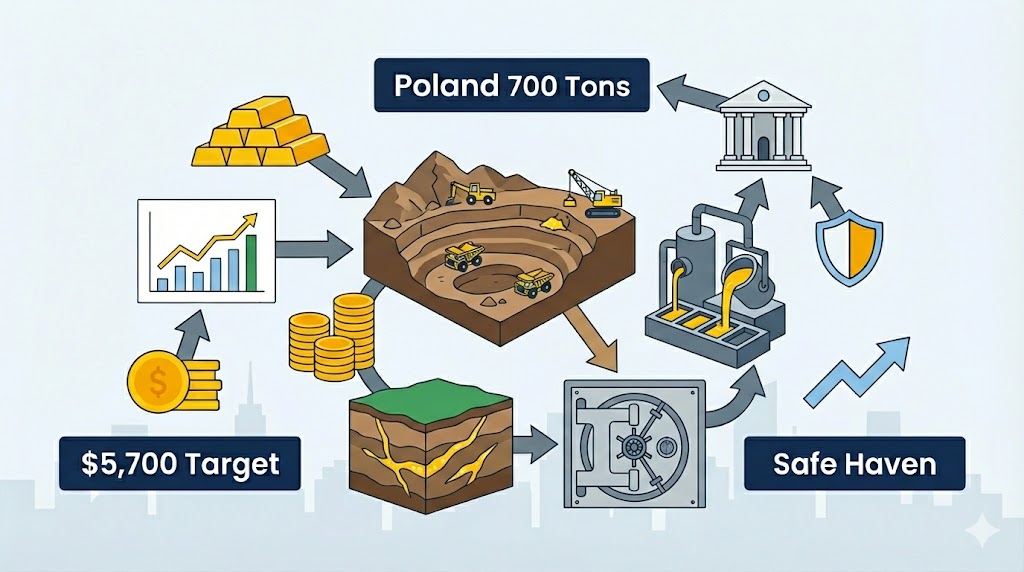

Here is a question for you: What feels heavier today? The gold bar in the vault, or the grocery bill in your pocket? As of January 27, 2026, gold has shattered the psychological barrier of $5,100 per ounce. While news headlines scream about “All-Time Highs,” the savvy investor at the desk next to you isn’t looking at the price chart. They are looking at Poland. Yes, Poland. While you were debating whether to buy or sell, the National Bank of Poland quietly announced a target to increase their gold reserves to 700 tons. This isn’t just a trade; it’s a structural shift in how nations view money. In this deep dive, we will dissect Morgan Stanley’s latest forecast of $5,700, analyze why central banks are panic-buying, and determine if there is still room for your capital in this crowded trade.

1. The Poland Shock: Why Central Banks Are Hoarding

Let’s ignore the noise and focus on the signal. The most critical takeaway from recent market movements isn’t the geopolitical tension in the Middle East or Eastern Europe—it’s the behavior of the “Whales.” Historically, central banks treated gold as a legacy asset, a dusty relic of the past. That narrative has officially died.

1.1 From Percentage to Absolute Tonnage

Amy Gower, Morgan Stanley’s commodity strategist, highlighted a pivotal change in her recent Bloomberg interview. Traditionally, central banks managed gold as a percentage of their total reserves. If the gold price went up, they would stop buying or even sell to maintain that percentage. It was a self-correcting mechanism that capped prices.

However, the National Bank of Poland (NBP) changed the rules. They announced a target of 700 tons in absolute terms. This means they don’t care if the price is $2,000 or $5,000; they are buying to hit a weight target. This implies roughly 150 tons of additional buying from one single player. When price sensitivity disappears from the largest buyers, the floor price moves significantly higher.

1.2 The De-Dollarization Trend

Why are Poland, China, and emerging markets doing this? It is the “Weaponization of Finance.” After witnessing the freezing of Russian assets in 2022, sovereign nations realized that Treasury bonds are not risk-free if you are on the wrong side of Washington. Gold has no counterparty risk. It cannot be frozen by a sanction decree. This structural demand is creating a safety net for gold prices that didn’t exist in previous cycles.

| Buyer Type | Buying Motivation (Past) | Buying Motivation (2026) | Impact on Price |

|---|---|---|---|

| Central Banks | Portfolio Rebalancing | Strategic Sovereignty & Sanction Proofing | Strong Floor (Structural Support) |

| Institutional Investors | Inflation Hedge | FOMO & Momentum Trading | High Volatility |

| Retail (You & Me) | Jewelry & Gifts | Wealth Preservation | Lagging Indicator |

2. Morgan Stanley’s $5,700 Call: The Bull Case

Is $5,100 the ceiling? Morgan Stanley argues we are looking at $5,700 by the second half of 2026. This isn’t just optimism; it’s based on a convergence of macro drivers.

2.1 The Real Rates Argument

Gold yields nothing. Therefore, it hates high interest rates. But as the Federal Reserve and ECB continue their rate-cutting cycles in 2026 to prevent a recession, the “opportunity cost” of holding gold diminishes. Real rates (Nominal Rate minus Inflation) are trending lower. History shows that whenever real rates dip below 1%, gold enters a parabolic phase. We are seeing early signs of this correlation re-establishing itself.

2.2 The Dollar Weakness

The US Dollar Index (DXY) has shown signs of fatigue. A weaker dollar makes gold cheaper for holders of other currencies (like the Euro, Yen, or Yuan), stimulating demand. If the US economy slows down faster than its peers, the dollar’s decline will act as rocket fuel for precious metals.

3. The Bear Case: What Could Crash the Price?

A wise investor always looks down before looking up. Howard Marks often asks, “What is the risk?” In the current gold rush, the risk is paradoxically “Peace and Stability.”

3.1 The Trump Tariff Resolution

Much of the current premium is built on fear—fear of trade wars and tariffs under the Trump administration. However, Trump is a dealmaker. If a sudden comprehensive trade deal is struck with major partners, or if geopolitical conflicts in Ukraine or Gaza see a surprise ceasefire, the “Fear Premium” will evaporate overnight. In such a scenario, we could see a rapid correction of 10-15%, dragging prices back down to the $4,500 levels.

3.2 Sticky Inflation and Fed Reversal

If inflation proves stubborn and the Fed is forced to pause cuts or hike rates again, the entire thesis collapses. Gold would be dumped in favor of high-yield bonds.

| Scenario | Probability | Price Target | Strategic Response |

|---|---|---|---|

| Bull Case (Rate Cuts + CB Buying) | 60% | $5,700+ | Hold & Add on Dips |

| Base Case (Status Quo) | 25% | $5,100 – $5,300 | Maintain Allocation |

| Bear Case (Geopolitical Resolution) | 15% | < $4,600 | Keep Cash Ready to Buy |

4. Action Plan: How to Allocate Capital Now

So, should you buy at $5,100? The answer depends on your timeline. If you are looking to flip for a quick profit next week, stay away. The volatility is too high. But if you are building a portfolio for the next decade, gold serves as the goalkeeper of your wealth.

4.1 The 5-10% Rule

Do not go “All-In.” Professional asset allocators recommend a 5% to 10% exposure to gold. This amount is enough to hedge your portfolio against a crash but not enough to drag down your returns if the stock market rallies. It is insurance, not a lottery ticket.

4.2 Execution: How to Buy (US Market)

Forget buying jewelry; the markup fees will kill your returns. For the US-based or global investor with access to NYSE/Nasdaq, here are the most efficient vehicles:

- SPDR Gold Shares (GLD): The most liquid gold ETF in the world. Good for institutional-sized trades, though the expense ratio is slightly higher.

- iShares Gold Trust (IAU): A lower-cost alternative to GLD. Perfect for the buy-and-hold retail investor.

- Newmont Corporation (NEM): If you want leverage and dividends, buy the miner, not the metal. Newmont is the industry leader, offering a dividend yield that physical gold cannot match. However, be aware that miners carry operational risks (strikes, regulations) that the metal does not.

| Instrument | Ticker | Best For… | Key Risk |

|---|---|---|---|

| Gold ETF | GLD / IAU | Pure Price Exposure | Management Fees |

| Mining Stock | NEM | Leverage & Dividends | Operational Execution |

| Physical Gold | Coins/Bars | Doomsday Prepping | Storage & Theft |

References & Further Reading

- Bloomberg Television, “Gold, Precious Metals Seeing Multiple Drivers, Says Morgan Stanley’s Gower”, Jan 26, 2026.

- World Gold Council (WGC), “Central Bank Gold Reserves Trends 2025”, 2025.

- Morgan Stanley Research, “2026 Commodity Outlook: The path to $5,700”, Jan 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. The views expressed here are based on data available as of January 27, 2026. Gold investments carry risks, including potential loss of principal. Please consult with a certified financial planner before making any investment decisions.