It is February 4, 2026. You open your portfolio app, and the sea of red numbers is glaring. Just a week ago, gold was celebrating an all-time high near $5,600. Today? It is fighting to hold the $5,000 line. The trigger was swift and political: President Trump’s nomination of Kevin Warsh as the next Fed Chair. The narrative on Wall Street shifted overnight from “Inflation is forever” to “The Hawk is back.” But before you hit the panic sell button on your gold miners, let’s look at the actual data. Is this the end of the precious metals super-cycle, or is it the precise “healthy correction” we have been waiting for? In this deep dive, we analyze the $500 drop, the $117 Newmont opportunity, and why the smartest players are quietly moving profits into the Energy sector.

1. The Warsh Effect: Why Gold Crashed 10%

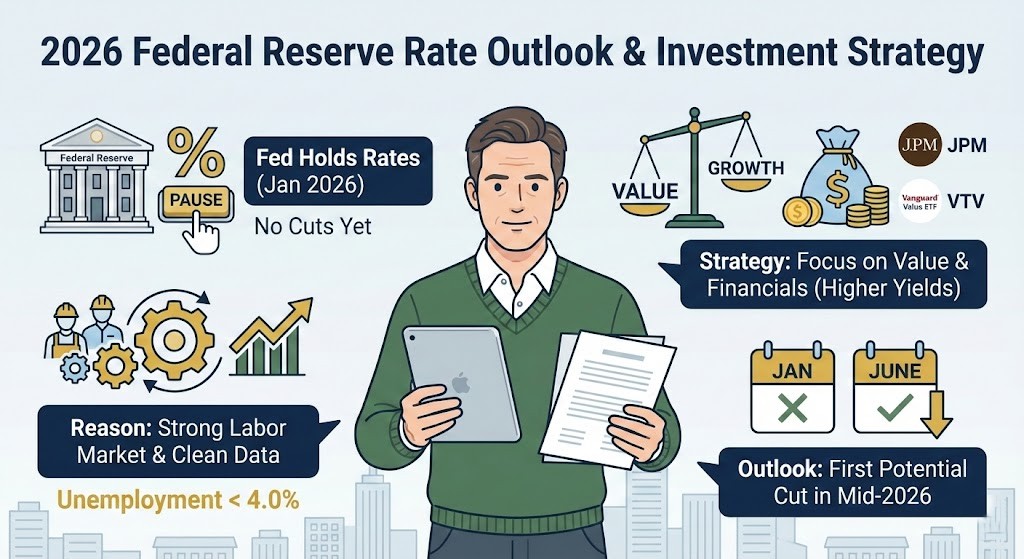

The market hates uncertainty, but it hates a “Strong Dollar” policy even more when it is long on commodities. On January 30, the announcement that Kevin Warsh—a known critic of the Fed’s loose monetary policy—would succeed Jerome Powell sent shockwaves through the precious metals market. The logic is simple: Warsh equals higher real rates, and higher real rates are kryptonite for non-yielding assets like gold and silver.

1.1 The Market’s Knee-Jerk Reaction

Let’s look at the scoreboard. Gold spot prices plummeted from a peak of $5,594 to test $5,090 levels. Silver took a harder hit, dropping over 25% from its highs to trade under $90. This wasn’t a fundamental shift in supply and demand; it was a liquidation event. Hedge funds that were leveraged long on the “Fed Pivot” narrative suddenly had to unwind their positions. However, as Howard Marks often reminds us, “Price is what you pay, value is what you get.” The drop is driven by sentiment, not a sudden discovery of new gold mines.

1.2 The “Hard Money” Narrative

Warsh is viewed as a “Sound Money” advocate. The market fears he will shrink the Fed’s balance sheet aggressively. But here is the reality check: Can the US government, with its current debt levels, actually afford a hawkish Fed? The bond market is skeptical, and so should you be. This dip is likely a pricing anomaly, a temporary disconnect between the political headline and the economic reality of 2026.

| Asset Class | Peak Price (Jan ’26) | Current Price (Feb 4) | Drawdown (%) | Market Sentiment |

|---|---|---|---|---|

| Gold Spot | $5,594 | $5,136 | -8.2% | Panic Selling / Correction |

| Silver Spot | $121.64 | $89.41 | -26.5% | Capitulation |

| Newmont (NEM) | $134.88 | $117.12 | -13.2% | Oversold Opportunity |

2. Fact Check: Is the Bull Market Dead?

When prices drop, narratives turn negative. Suddenly, analysts who called for $6,000 gold are quiet. But let’s look at the earnings and valuations of the companies you actually own. The fundamentals of the gold miners are stronger today than they were when gold was at $4,000.

2.1 Newmont at $117: A Value Trap or a Gift?

Newmont Corporation (NEM) closed at $117.12 on February 3. Just weeks ago, it was trading near $135. Does a change in Fed leadership reduce the amount of gold Newmont pulls out of the ground? No. With gold prices still hovering above $5,000, Newmont’s free cash flow generation is massive. At a P/E ratio of around 18x (based on current estimates), it is trading at a discount compared to the broader tech-heavy S&P 500. The “Wild Swings” mentioned in recent Bloomberg reports are noise; the cash flow is the signal.

2.2 Barrick Gold’s Lagging Performance

Barrick Gold (GOLD) is trading at $47.55. It has lagged behind its peers, but this makes it potentially more attractive for value investors. With a P/E of roughly 22x, it is slightly more expensive than Newmont relative to earnings, but its balance sheet remains pristine. The question you need to ask is not “Will gold go lower?” but “Can these companies make money at $4,500 gold?” The answer is an emphatic yes. Their all-in sustaining costs (AISC) are well below current spot prices, ensuring profitability even in a severe bear case.

| Ticker | Price (Feb 4) | P/E Ratio (Est.) | 52-Week High | Verdict |

|---|---|---|---|---|

| NEM (US) | $117.12 | 18.2x | $134.88 | Strong Buy on Dip |

| GOLD (US) | $47.55 | 22.8x | $54.69 | Accumulate |

| XOM (Energy) | $111.44 | 11.2x | $128.00 | Rotation Target |

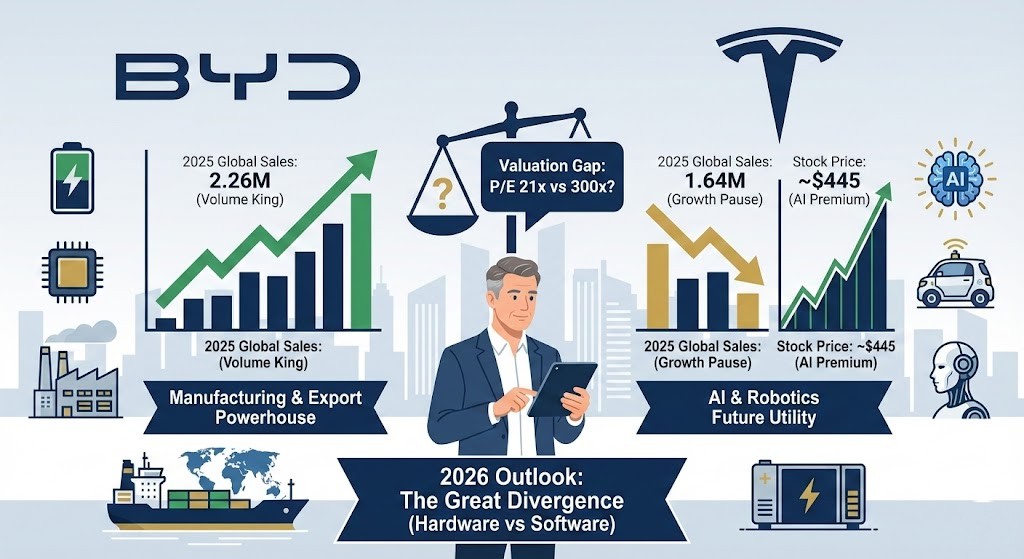

3. The Great Rotation: From Gold to Oil

Here is the most critical insight from the recent market moves: Capital is not just leaving gold; it is looking for a new home. And that home appears to be the Energy sector. While everyone was watching gold hit $5,500, oil has been quietly consolidating.

3.1 Why Energy Now?

The Bloomberg guest analysis suggests a tactical pivot. If the dollar strengthens under Warsh, commodities generally suffer. However, energy stocks like Exxon Mobil (XOM) and Chevron (CVX) have detached from pure commodity price correlation and are trading based on their massive dividends and buybacks. Energy is the “Value” play that complements the “Insurance” play of gold. In a world of geopolitical instability—which hasn’t gone away just because of a Fed nomination—energy security is paramount.

3.2 The Rotation Strategy

This is not about selling all your gold to buy oil. It is about rebalancing. If your gold allocation has grown to 20% of your portfolio due to the recent rally, trimming it back to 10-15% and deploying that capital into undervalued energy majors (trading at 11x earnings vs. Gold miners at 18-22x) is a classic “Buy Low, Sell High” move. It reduces volatility while keeping your inflation hedge intact.

4. Action Plan: What to Buy Now

So, what should you do today? The screen is red, and the fear is palpable. This is usually the time to act.

4.1 For the US Investor

If you are in the US market, look at the SPDR Gold Shares (GLD) for liquidity, but prefer the miners for leverage. Newmont (NEM) at $117 offers a compelling entry point with a decent dividend yield. For the energy rotation, the Energy Select Sector SPDR Fund (XLE) is the easiest way to gain broad exposure to the oil majors without picking single stocks.

4.2 Global Alternatives

For our global readers, the strategy remains the same but the tools differ. In Korea, the ACE KRX Gold Spot (411060) offers tax advantages. In Japan, the Mitsubishi UFJ Pure Gold Trust (1540) is essential for hedging against Yen volatility. The key is to own the asset, not the paper promise. Do not let the volatility shake you out of a secular trend. The debt isn’t gone, the deficits aren’t fixed, and Kevin Warsh cannot print gold.

References

- Bloomberg Television, “Gold, Silver Continue Wild Swings”, Jan 30, 2026

- Google Finance, Newmont Corporation (NEM) Market Data, Feb 04, 2026

- Google Finance, Barrick Gold Corp (GOLD) Market Data, Feb 04, 2026

- Kyodo News, “Trump taps ex-Fed governor Kevin Warsh to chair U.S. central bank”, Jan 31, 2026

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Market data is based on the situation as of February 4, 2026. Please consult with a financial professional before making any investment decisions.