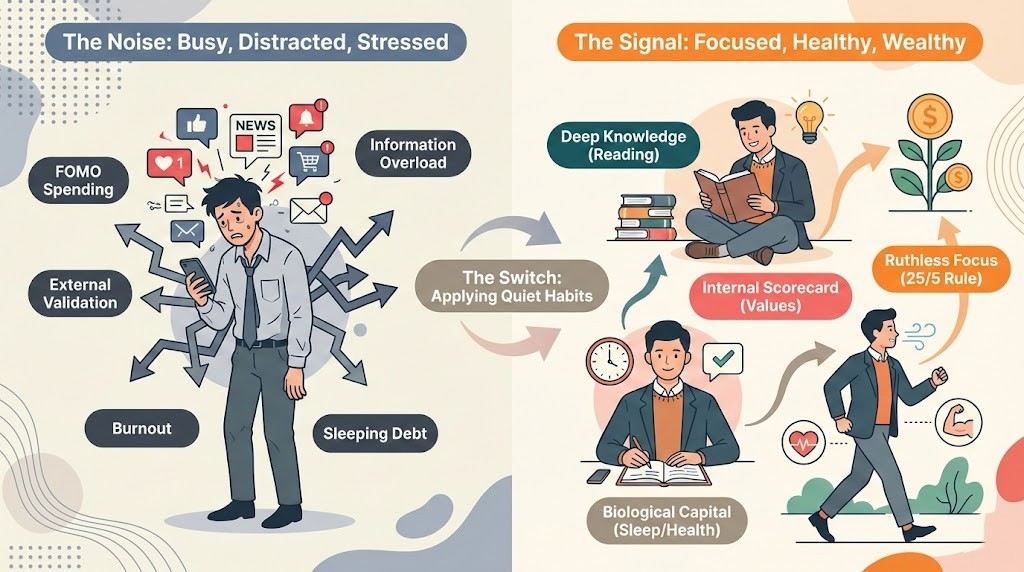

Imagine it is 11:30 PM on a Tuesday. You have just finished replying to the last urgent email from your boss, your smartwatch is alerting you that your stress levels are high, and despite earning a decent salary, you feel a gnawing sense of financial insecurity. You open social media, only to see a former colleague boasting about early retirement or a crypto windfall. This is the reality for many professionals in 2026: we are working harder than ever, yet the finish line seems to keep moving further away. The noise of the market and the pressure to “keep up” are drowning out our ability to think clearly. But what if the secret to breaking this cycle isn’t about doing more, but doing significantly less, with greater precision? We analyzed the timeless principles of capital allocation legends and adapted them for today’s high-noise, high-anxiety economy. These aren’t just investment tips; they are a survival kit for your attention span and your bank account.

1. The Compounding Engine: Knowledge Over Noise

In an era where AI generates content faster than we can consume it, the ability to filter information is more valuable than the ability to access it. Most of us suffer from “information obesity”—consuming vast amounts of low-quality data that provides no nutritional value to our decision-making.

1.1 Deep Work in the Era of 8-Second Attention Spans

The habit of reading 500 pages a day, often attributed to top investors, seems impossible now. However, the core principle is not about volume; it is about depth. While your competitors are skimming headlines and reacting to 15-second market updates, the person who dedicates one hour to reading a primary source (an annual report, a technical whitepaper, or a history book) builds a competitive moat. In 2026, “thinking time” is the scarcest asset. By blocking out distraction-free periods, you allow knowledge to compound, creating unique insights that AI summaries cannot replicate.

1.2 The “Too Hard” Pile: Admitting What We Don’t Know

We often feel pressured to have an opinion on everything—from geopolitical shifts to the latest tech trends. This leads to costly mistakes. Adopting a “Too Hard” pile meant acknowledging your circle of competence and staying within it. If you don’t understand how a specific derivative works or why a certain stock is soaring, simply passing on it is not a weakness; it is a strategic defense mechanism that preserves your capital for the few bets you truly understand.

| Information Habit | Typical Behavior (The Noise) | Strategic Behavior (The Signal) | Expected Outcome |

|---|---|---|---|

| Source Selection | Social media feeds, headlines, 1-minute summaries | Primary documents, books, long-form analysis | Independent thinking vs. Herd mentality |

| Reaction Speed | Immediate reaction to market volatility | Delayed response after cooling-off period | Rational decisions vs. Emotional panic |

| Knowledge Depth | Surface-level familiarity with many topics | Deep expertise in a niche “Circle of Competence” | High conviction bets vs. Gambling |

2. The Internal Scorecard: Escaping the Comparison Trap

The most dangerous financial derivative in 2026 isn’t a complex option strategy; it is the “External Scorecard.” This is the need to show the world how well you are doing, often at the expense of how well you are actually doing.

2.1 Detaching Self-Worth from Market Fluctuations

Living by an inner scorecard means you are satisfied if you did the right thing, even if others think you are wrong. Conversely, relying on an outer scorecard means you feel good only when others applaud you, even if you know you acted foolishly. In a transparent digital world where everyone’s highlight reel is visible, maintaining an internal standard of success is the only way to avoid the lifestyle inflation that destroys wealth. It is about being rich rather than just looking rich.

2.2 The Power of Unpopular Decisions

True wealth is often built in silence. It involves driving an older car when you could afford a new one, or holding cash when everyone else is frantically buying the latest hype. These decisions are socially difficult but financially rewarding. The psychological fortitude to stand apart from the crowd is a skill that must be practiced daily. It protects you from the “institutional imperative”—the mindless imitation of what peers are doing.

| Decision Framework | External Scorecard (Common) | Internal Scorecard (Wealth Builder) | Impact on Life Quality |

|---|---|---|---|

| Spending Logic | “What will my neighbors/colleagues think?” | “Does this add value to my life?” | Freedom from debt and validation seeking |

| Career Choice | Chasing prestigious titles/brands | Focusing on skill acquisition and autonomy | Long-term satisfaction vs. Burnout |

| Investment Style | FOMO-driven buying (Fear Of Missing Out) | Value-driven buying (JOMO – Joy Of Missing Out) | Sleep quality improves, anxiety drops |

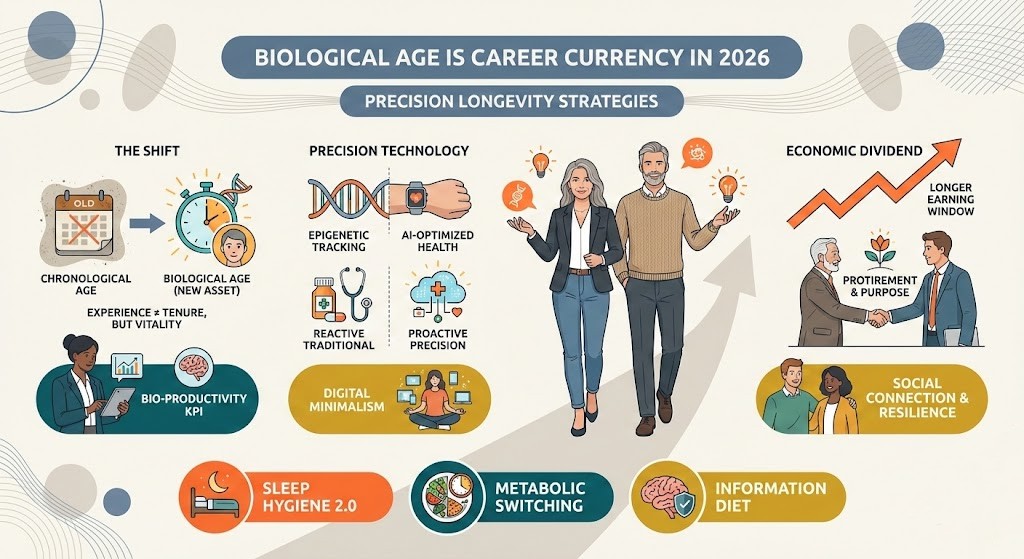

3. Biological Capital: Treating Your Body Like a 100-Year Asset

Imagine you were given only one car for your entire lifetime. You would read the manual twice, change the oil meticulously, and fix every scratch immediately. You have only one mind and one body. In 2026, health is the ultimate hedge against uncertainty.

3.1 Precision Wellness vs. Fad Diets

Modern “Bio-investing” moves beyond generic advice. It is about understanding your personal data—sleep cycles, stress markers, and metabolic health. Just as you wouldn’t invest in a company without looking at its balance sheet, you shouldn’t manage your health without understanding your body’s signals. The goal isn’t just to live longer (lifespan), but to stay functional and cognitively sharp for as long as possible (healthspan).

3.2 Sleep as the Ultimate Investment Strategy

Decisions made by a tired brain are rarely profitable. Chronic sleep deprivation acts like a high-interest loan against your cognitive future. Prioritizing rest is not laziness; it is risk management. It ensures that when you do make those few critical decisions each year, your judgment is clear, unemotional, and precise.

| Asset Class | Depreciating Approach | Appreciating Approach | Long-term ROI |

|---|---|---|---|

| Physical Body | Ignoring minor symptoms, irregular sleep | Preventive maintenance, consistent rhythm | Reduced medical costs, higher energy |

| Mental State | Constant dopamine hits (scrolling) | Periods of boredom and reflection | Clarity, creativity, emotional stability |

| Environment | Toxic relationships, chaotic spaces | Curated network, organized environment | Support system during crises |

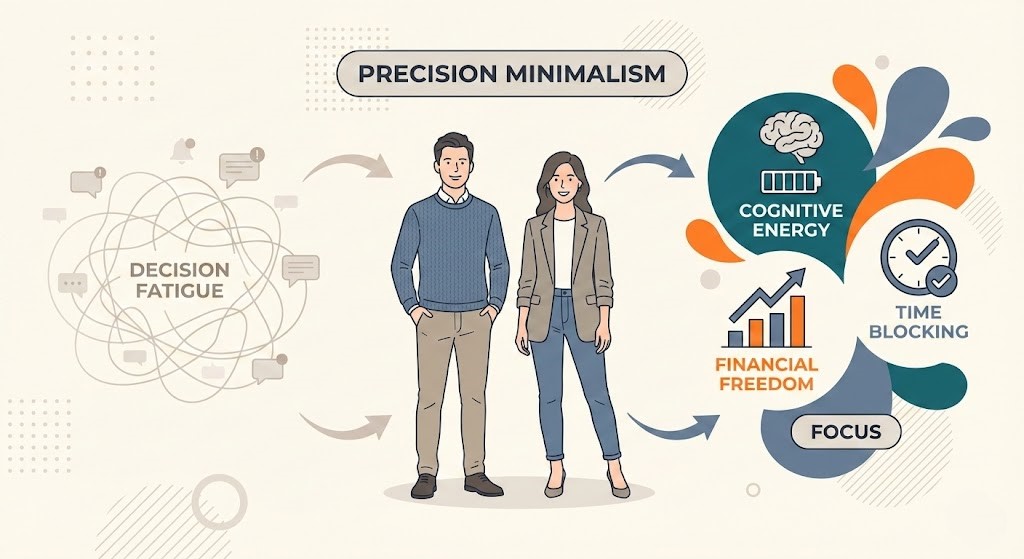

4. The Art of Subtraction: Ruthless Prioritization

Success often breeds complexity, and complexity kills returns. The antidote is a relentless focus on simplicity.

4.1 The 25/5 Rule Applied to Career Paths

List your top 25 goals. Circle the top 5. Now, strictly avoid the other 20. The other 20 are not just “less important”; they are the enemies of your top 5 because they distract you just enough to prevent you from succeeding at the things that matter most. In a workplace filled with endless projects and “side hustles,” the ability to say “no” to good opportunities is the only way to make room for great ones.

4.2 Saying “No” to Good Opportunities to Find Great Ones

We are conditioned to say “yes” to avoid offending others or missing out. However, every “yes” is a debt of time you must repay later. By guarding your calendar as aggressively as your portfolio, you create the slack necessary to seize the rare, life-changing opportunities when they finally appear.

References & Further Reading

- Global Wellness Institute, “The Future of Wellness 2025,” 2025.

- Edelman, “2026 Edelman Trust Barometer,” 2026.

- Newport, Cal, “Deep Work: Rules for Focused Success in a Distracted World” (Concepts adapted for 2026 context).

- Statista, “Digital Media Usage & Mental Health Correlation Report,” 2025.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial, medical, or professional advice. The strategies discussed may not be suitable for your specific situation. Always consult with a qualified professional before making major financial or health decisions.