Imagine you are an investor who bought Nvidia shares three years ago. You are happy with the returns, but now you are worried. “Is it too late to buy more?” “Where will the AI money flow next?” These are the questions keeping smart investors awake at night. The answer lies not in the cloud, but on the ground. At CES 2026, a historic handshake between Jensen Huang of Nvidia and Roland Busch of Siemens signaled the start of a new era: Physical AI. The AI brain is now getting a body. This shift from virtual chatbots to industrial robots is opening a massive window of opportunity for undervalued industrial giants. Let’s dive into why your portfolio needs to pivot from “Digital AI” to “Physical AI” right now.

1. The Shift from Cloud to Factory Floors

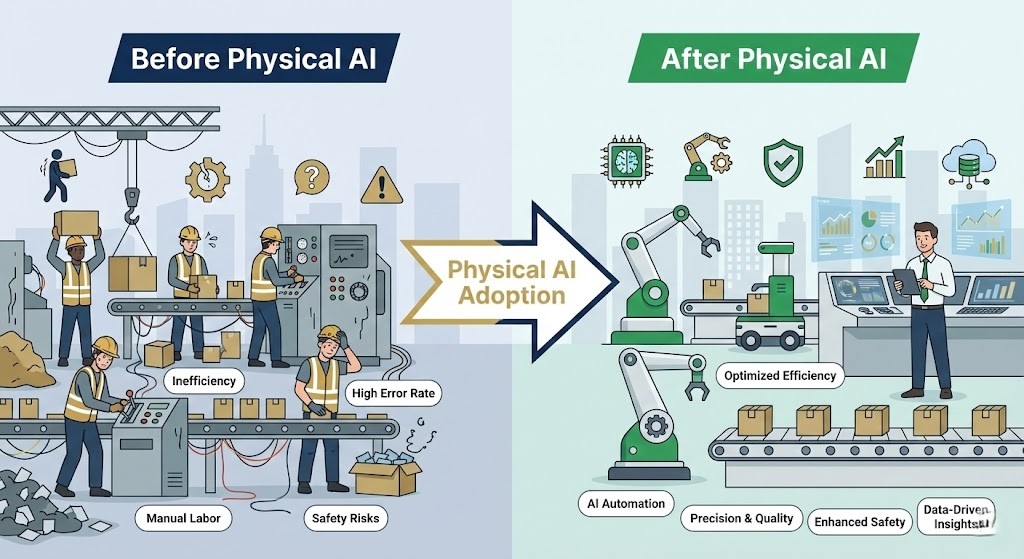

For the past few years, the AI revolution has been invisible. It lived in massive data centers, processing text and images. But now, AI is learning to interact with the physical world. This is what we call “Physical AI.” The partnership between Nvidia and Siemens is not just a press release; it is the integration of the best AI chips with the world’s best industrial software.

1.1 Why Software Is Eating the Factory

Think of a modern factory. It is no longer just gears and conveyor belts. It is a massive computer. Siemens has built the “Industrial Metaverse” where products are designed and tested virtually before a single screw is turned in the real world. This “Digital Twin” technology saves billions in costs. Investors often overlook this, treating Siemens like a boring old manufacturer. In reality, it is becoming a high-margin software company.

1.2 The Trillion-Dollar Opportunity in Automation

Labor shortages are a global crisis. From Germany to Japan to the US, there are not enough skilled workers. The only solution is automation. This is not a choice; it is a survival necessity for businesses. Companies that provide the “brain” (AI) and the “nervous system” (sensors and automation) for these robots will see explosive growth. We are moving from the “Internet of Things” to the “Intelligence of Things.”

| Analysis Item | Traditional Manufacturing | The Future of Physical AI | Action for Investors |

|---|---|---|---|

| Core Value | Hardware & Assembly | Software & Digital Twins | Focus on margin expansion |

| Growth Driver | Global GDP Growth | Automation & Labor Shortage | Buy the technology providers |

| Market Perception | Cyclical & Low PE | Secular Growth & High PE | Re-rate valuation multiples |

2. Siemens vs Nvidia Valuation Analysis

Everyone knows Nvidia is the king of AI. But is it the best investment today at $184.95? Investing is about finding value where others do not see it. While Nvidia is priced for perfection with a high P/E ratio, its industrial partners are trading at deep discounts.

2.1 The Valuation Gap Explained

Let’s look at the numbers. Nvidia trades at nearly 40 times forward earnings. This means the market expects flawless execution for years. On the other hand, Siemens (Ticker: SIE) trades at roughly 23 times earnings. The market still sees it as a hardware company. As Siemens’ software revenue grows, this valuation gap will close. This “re-rating” is where the big money is made.

2.2 Risk vs Reward in 2026

If Nvidia misses earnings by even a small margin, the stock could correct sharply. However, industrial giants like Siemens have a floor. They pay steady dividends and have massive backlogs of orders. For a prudent investor, shifting some profit from high-flying tech stocks into these industrial compounders offers a better risk-adjusted return profile.

| Ticker | Current Price | Consensus Target | P/E Ratio (12m Fwd) |

|---|---|---|---|

| Nvidia (NVDA) | $184.95 | ~$200.00 | 39.4x |

| Siemens (SIE) | €254.20 | €270.00 | 23.3x |

| Rockwell (ROK) | $413.36 | $401.70 | 34.0x |

3. Energy Efficiency and Schneider Electric

AI consumes a massive amount of electricity. We are running out of power capacity. This is the biggest bottleneck for the AI industry. This problem creates a new winner: Energy Management.

3.1 The Green AI Thesis

Schneider Electric is not just making circuit breakers. They are the leaders in making data centers and factories energy-efficient. Every time Nvidia sells a new AI server, a data center needs to upgrade its power infrastructure. Schneider provides that infrastructure. It is a pick-and-shovel play on the AI boom.

3.2 Why Energy Management Matters

Governments are enforcing strict carbon emission rules. Companies must reduce energy usage. Schneider Electric helps them do that. This regulatory tailwind, combined with the AI demand, creates a “double engine” for growth. The stock is currently trading below its potential target, offering a safer entry point than volatile tech stocks.

| Company | Key Driver | Bull Case Scenario | Bear Case Scenario |

|---|---|---|---|

| Schneider Electric | Data Center Power | AI power demand doubles | Global recession hits CAPEX |

| Siemens Energy | Grid Upgrade | Renewable transition accelerates | Project delays & cost overruns |

| Rockwell Automation | US Reshoring | Manufacturing boom in US | Slowdown in factory spend |

4. Strategic Portfolio Allocation for 2026

So, how do you act on this information? Do not sell all your Nvidia stock. Instead, balance it. We need a portfolio that can handle both growth and stability.

4.1 The Barbell Strategy

Keep your core exposure to AI leaders like Nvidia, but balance it with industrial software leaders like Siemens and Schneider. This is called a “Barbell Strategy.” On one side, you have high-growth, high-risk tech. On the other side, you have steady, dividend-paying industrial growth. This protects you if the tech bubble deflates, but keeps you in the game if the rally continues.

4.2 Upcoming D-Day Events

Mark your calendar. On February 12, 2026, Siemens will report earnings. Watch their “Digital Industries” margin. If it goes up, the thesis is working. On February 25, Nvidia reports. Listen for mentions of “Industrial AI” or “Sovereign AI.” These keywords confirm that the money is flowing exactly where we predicted.

References

- Bloomberg, “Nvidia and Siemens Expand Partnership to Industrial Metaverse”, 2026

- Siemens AG, “Q1 2026 Financial Earnings Report & Outlook”, 2026

- Reuters, “Global Industrial Automation Market Size & Share Analysis”, 2025

Disclaimer

This content is for informational purposes only and does not constitute financial advice. All investments involve risk, including the loss of principal. The stock prices mentioned are as of January 12, 2026. Please conduct your own research or consult a certified financial planner before making any investment decisions.