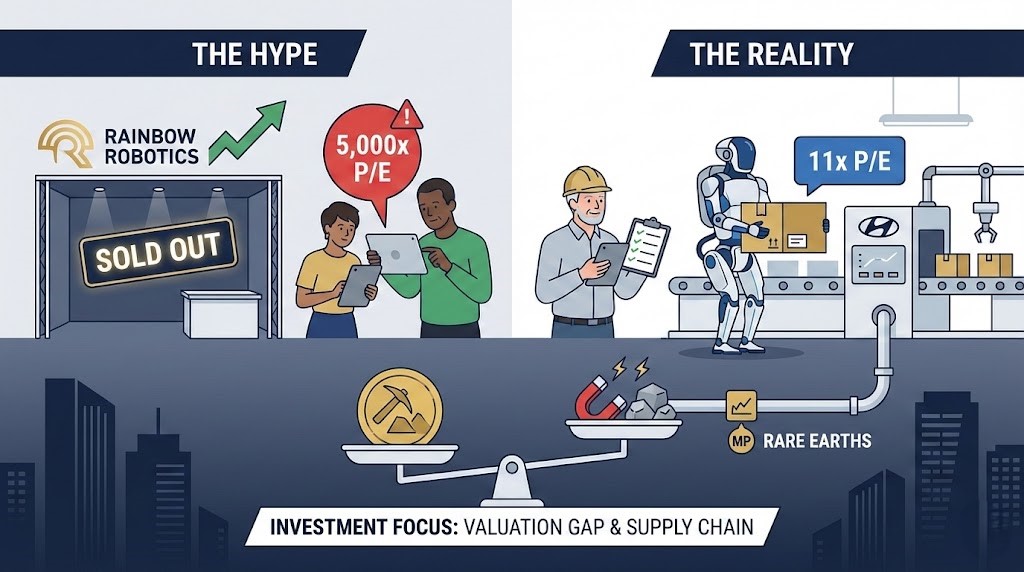

Consider Michael, a 52-year-old logistics manager in Chicago. He’s spent the last week reading headlines about CES 2026, watching videos of backflipping robots, and feeling a pang of regret as he looks at his stagnant portfolio. He sees Korean robotics stocks soaring to new all-time highs and wonders if he missed the boat. But here is the strange reality Michael missed: The company whose stock price doubled didn’t even show up to the exhibition. This disconnect between price and reality is where the greatest risks—and opportunities—lie today. As of January 20, 2026, we are witnessing a classic market anomaly where “hope” is trading at a 5,000% premium over “execution.”

1. Market Reaction to CES 2026 Absence

The most defining moment of CES 2026 was not what was seen, but what was unseen. Thousands of investors and journalists flocked to the Las Vegas Convention Center expecting to see the future of automation from Samsung Electronics’ affiliate, Rainbow Robotics. They found nothing. There was no booth, no demonstration, and no new humanoid unveiling. Logic dictates that when a growth company fails to present its core product at the world’s largest tech expo, its stock price should correct. Instead, the opposite happened.

1.1 The Psychology of the “Invisible” Rally

In the absence of a tangible product, the market filled the void with imagination. Rumors of secret developments and future M&A activity drove Rainbow Robotics (277810.KQ) to a record high of 511,000 KRW. This is a textbook example of “Greater Fool Theory,” where asset prices are driven not by intrinsic value but by the expectation that someone else will pay even more for the same asset. Investors are buying the brand name of Samsung, not the actual industrial output of the robotics company.

1.2 Comparing Booth Traffic to Stock Performance

Contrast this with the Hyundai Motor Group booth. Their acquired subsidiary, Boston Dynamics, showcased the fully electric “Atlas” robot performing complex, autonomous logistics tasks—not behind a glass case, but in a simulated factory environment. Yet, Hyundai’s stock (005380.KS) fell 2.5% this week. The market is currently punishing the company that is spending money to build real factories while rewarding the company that is saving money by showing nothing. History teaches us that such divergences eventually converge, usually painfully for the speculators.

| Company | CES 2026 Presence | Stock Performance (1W) | Market Sentiment |

|---|---|---|---|

| Rainbow Robotics | Absent (No Show) | +6.25% (Soaring) | Speculative Euphoria |

| Hyundai Motor | Active Demo (Atlas) | -2.50% (Correction) | Skeptical / Ignored |

| UBTECH (China) | Acrobatic Demo | +2.18% (Stable) | Visual Hype |

2. Valuation Discrepancy Between Hyundai and Rainbow

Price is what you pay; value is what you get. Currently, the price investors are paying for future growth expectations has reached a level that demands mathematical scrutiny. We need to look at the Price-to-Earnings (PER) ratio to understand the magnitude of the bet being placed.

2.1 The 5,000x Multiple Anomaly

As of January 19, 2026, Rainbow Robotics is trading at a PER of approximately 5,099x. To justify this valuation, the company would need to grow its earnings at an exponential rate for the next two decades without a single stumble. This is not investing; it is pricing in a lottery win. The market cap has detached from the fundamentals of revenue and operating profit. Investors are paying for a narrative that implies Rainbow will dominate the global service robot market, a claim that remains unsubstantiated by current export data or technological moats.

2.2 The Manufacturing Discount of Hyundai

On the other side of the spectrum, Hyundai Motor trades at a PER of 11.7x. The market views it strictly as a legacy car manufacturer, ignoring the embedded optionality of its robotics division. Hyundai is not just testing robots; it is deploying them in its HMGMA (Hyundai Motor Group Metaplant America) facility. When a robot moves from the R&D lab to the factory floor, it changes from a cost center to a productivity multiplier. The market is currently assigning zero or negative value to Hyundai’s leadership in “Physical AI,” presenting a margin of safety for the value-oriented investor.

| Metric | Hyundai Motor (Real Economy) | Rainbow Robotics (Expectation) | Tesla (The Benchmark) |

|---|---|---|---|

| Current Price | 486,000 KRW | 511,000 KRW | $437.52 |

| P/E Ratio | 11.7x | 5,099x | 292.6x |

| Primary Asset | Global Factories + Atlas | Samsung Partnership | Optimus + FSD |

| Risk Profile | Low (Asset Heavy) | Extreme (Bubble) | High (Growth) |

3. Technical Analysis of Chinese vs. US Robotics

During CES 2026, social media was flooded with videos of Chinese robots performing backflips and dance routines. While visually impressive, these demonstrations often mask significant technological limitations.

3.1 Teleoperation vs. Autonomy

Reports from the exhibition floor indicate that many Chinese humanoid robots, such as those from UBTECH, were heavily reliant on teleoperation—human pilots using joysticks to control the movements. This is “Digital Puppetry,” not Artificial Intelligence. A robot that requires a human to balance it is essentially a very expensive remote-controlled car. In contrast, the Atlas robot demonstrated by Boston Dynamics utilized onboard inference for path planning and object manipulation. For an investor, the distinction is critical: A remote-controlled robot cannot solve the labor shortage crisis; only an autonomous one can.

3.2 The Durability Question in Industrial Use

Industrial environments are harsh. A robot that can do a backflip is not necessarily one that can carry a 20kg box for 16 hours a day without overheating. The emphasis on dynamic acrobatics by Chinese competitors distracts from the boring but essential engineering required for thermal management and joint durability. Hyundai’s approach with Atlas focuses on hydraulic and electric actuation designed for repetitive stress, which is the boring reality of where profits are actually generated.

4. Rare Earth Elements and Supply Chain Risks

Regardless of which robot wins the software war—whether it is Tesla’s Optimus, Hyundai’s Atlas, or a Chinese competitor—they all share a common hardware dependency: high-performance permanent magnets.

4.1 The Rare Earth Bottleneck

The powerful motors that allow these robots to move require Neodymium, Praseodymium, and Dysprosium. Currently, China controls a significant majority of the processing capacity for these elements. This geopolitical choke point is a risk for Western robotics companies but an opportunity for supply chain plays.

4.2 Hedging with Strategic Materials

Investors looking for a way to play the robotics boom without picking a specific winner should look at the upstream supply chain. MP Materials (MP), the only major rare earth mining and processing site in North America, has seen its stock rise to $68.98, up over 200% in the last year. As the production of humanoid robots scales from thousands to millions, the demand for magnetic materials will outstrip supply. Owning the mine is often safer than owning the manufacturer in a gold rush.

| Component | Key Material | Dominant Supplier | Investment Hedge |

|---|---|---|---|

| High-Torque Motors | Neodymium (NdPr) | China (85% share) | MP Materials (USA) |

| High-Temp Stability | Dysprosium (Dy) | China (Myanmar imports) | VanEck Rare Earth ETF |

| Battery / Power | Lithium / Nickel | Global / Indonesia | Albemarle / Vale |

References

- Sampro TV, “CES 2026 Field Report: Why Atlas Received Applause Over Dancing Robots,” 2026.

- Hyundai Motor Group, “HMGMA Automation and Robotics Integration Report,” 2025.

- Goldman Sachs, “The Future of Humanoid Robotics: Supply Chain Analysis,” 2026.

- Bloomberg Terminal Data, “Market Capitalization and PE Ratios for Robotics Sector,” Accessed Jan 19, 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. The securities mentioned (Hyundai Motor, Rainbow Robotics, MP Materials) carry risks, and past performance is not indicative of future results. Please consult with a qualified financial advisor before making any investment decisions.