Consider the situation of Sarah, a 45-year-old project manager in London. She has spent nearly two decades building her savings, yet as of early 2026, she finds herself in a dilemma. While her bank accounts offer meager interest, the cost of living continues to climb, and the global talk of an AI revolution feels like a distant wealth-building engine she cannot touch. Then, she looks at the foundation of it all: copper. On this Saturday, January 10, 2026, copper prices have shattered all expectations, trading at a staggering $13,060 per ton. This is not just another price spike; it is a structural realignment where Dr. Copper has become a tech-metal. With the US scooping up every available ton ahead of potential 2027 tariffs and the Fed pivoting to aggressive rate cuts, Sarah realizes that understanding this cycle is the key to preserving her purchasing power in a world that is being electrified at a record pace.

1. The Convergence of Global Rate Cuts and Structural Supply Deficits

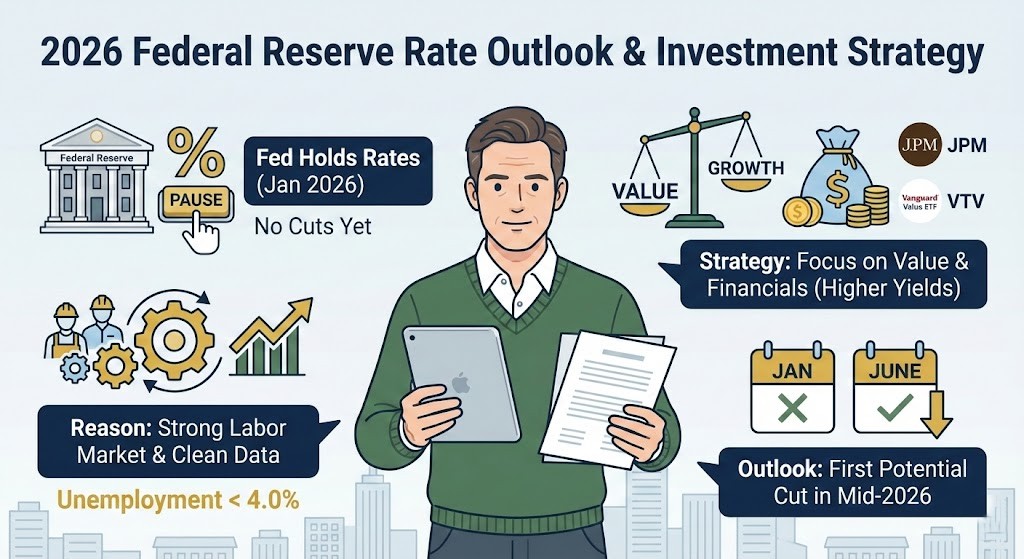

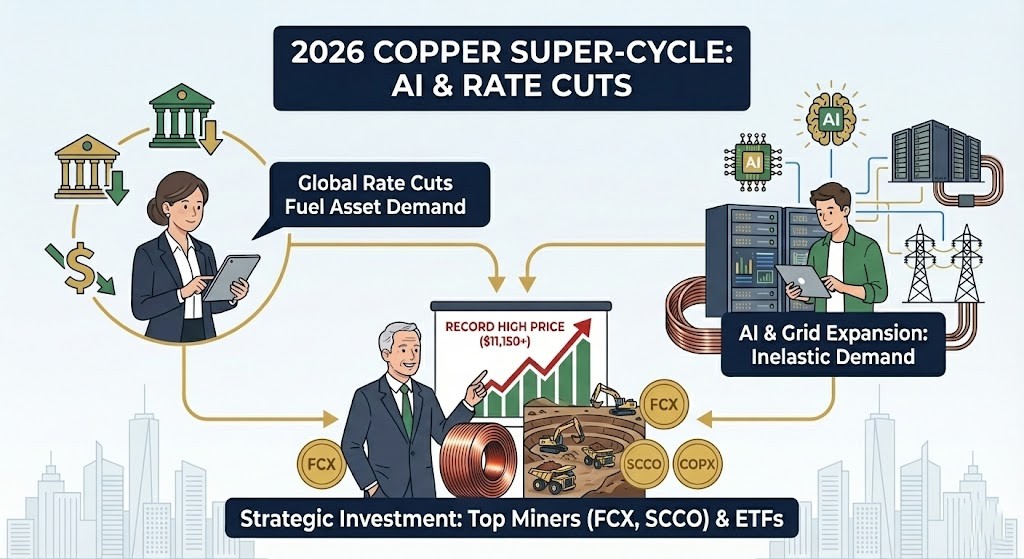

The copper rally of early 2026 is a masterpiece of market dynamics. For years, investors viewed copper through the narrow lens of Chinese construction activity. Today, that view is obsolete. The primary catalyst is the Federal Reserve’s decisive entry into a rate-cutting cycle. Lower interest rates do two things: they decrease the cost of holding physical commodities and they stimulate capital expenditure in copper-intensive sectors like green energy and automotive manufacturing. As the US dollar softens, copper becomes the preferred vessel for capital seeking real-asset exposure. This is why we are seeing a mass migration of institutional funds into the sector, pushing prices beyond the $13,000 mark.

1.1 Persistent Supply Disruptions from 2025 Carrying Over

We cannot ignore the supply side of the equation. The operational challenges and mine closures that plagued 2025 in Chile and Panama have not been resolved; they have metastasized. As we enter 2026, the market is facing a physical deficit that is being exacerbated by a lack of new mining projects. It takes over a decade to bring a new copper mine online, and the world is now paying the price for the underinvestment of the 2010s. For Sarah and other individual investors, this means the supply-demand gap is not a temporary glitch but a long-term feature of the market. To track these inventory levels in real-time, professional investors are utilizing advanced supply chain analytics that monitor port congestion and warehouse outflows before the data hits the mainstream news.

1.2 The Impact of 2027 Copper Tariffs on Current Pricing

Geopolitics has introduced a ‘fear premium’ that is currently driving prices higher. Discussions regarding potential US copper tariffs for 2027 have triggered an aggressive stockpiling phase. Corporations are not just buying for their immediate needs; they are securing copper for the next 24 to 36 months to hedge against future tax burdens. This ‘front-loading’ of demand has created a vacuum in the physical market, leaving spot buyers in a desperate scramble. This hoarding behavior provides a solid floor for prices, as the metal is being moved from liquid exchanges into private, strategic stockpiles.

| Analysis Factor | Previous Market Paradigm | The 2026 Reality | Actionable Strategy |

|---|---|---|---|

| Primary Demand Catalyst | Chinese Property Market | AI Data Centers & Electrification | Overweight miners with high-grade reserves |

| Supply Environment | Just-in-Time Efficiency | Strategic Regional Stockpiling | Monitor US and South American production closely |

| Monetary Backdrop | High Rates Suppressing Demand | Aggressive Rate Cuts Fueling Capex | Increase exposure to spot-price leveraged assets |

2. AI Infrastructure and the Global Power Grid as Permanent Demand Engines

In the past, copper was simply a building material. In 2026, it is officially a ‘technology metal.’ The massive expansion of AI data centers has created a demand vertical that is almost entirely price-inelastic. High-performance computing requires specialized power management, and moving electricity within these massive facilities requires immense amounts of copper busbars, high-voltage cabling, and advanced cooling systems. Every megawatt of data center capacity consumes between 25 and 60 tons of copper. As tech giants like Microsoft and Google accelerate their build-outs, the competition for high-purity copper is becoming a matter of national and corporate sovereignty.

2.1 Grid Modernization: The Multi-Decade Structural Trend

Beyond the tech sector, the global electrical grid is undergoing its most significant overhaul in a century. Renewable energy sources like wind and solar are distributed and variable, requiring five times more copper than traditional fossil fuel plants to connect to the network. In 2026, we are witnessing massive government spending programs in the US and Europe aimed at replacing aging transformers and expanding transmission lines. This is a structural necessity that persists regardless of short-term economic fluctuations. For Sarah, this represents a rare investment opportunity where the long-term demand is guaranteed by government policy and technological necessity.

2.2 Mapping the Copper Value Chain for Profit

To invest wisely, one must understand the value chain. Currently, the ‘Upstream’ miners are capturing the lion’s share of the profits as spot prices outpace mining costs. Midstream refiners are facing higher energy costs, and downstream manufacturers are struggling to pass on the full $13,000 price tag to consumers. Therefore, the strategic priority remains on the companies that actually own the ‘rocks’—the large-scale miners with the lowest cash costs and the most stable geopolitical footprints. To analyze the institutional flow into these mining giants, it is beneficial to use real-time market data platforms that track large-block trades and options activity.

3. Comparative Analysis of Mining Leaders: Freeport-McMoRan versus Southern Copper

When Sarah looks at where to place her capital, two names dominate the landscape: Freeport-McMoRan (FCX) and Southern Copper (SCCO). While both are industry titans, they offer very different paths to growth. FCX is the volume leader, with a massive presence in the US and Indonesia. It is highly leveraged to the spot price of copper, meaning it provides the most ‘beta’ or sensitivity to price movements. SCCO, on the other hand, is the low-cost fortress of the sector, boasting reserves that could last for the next 50 years.

3.1 Freeport-McMoRan (FCX): High Beta and Strategic Growth

As of January 10, 2026, FCX is trading at $56.53. The company has successfully navigated the transition to underground mining at its massive Grasberg mine in Indonesia, providing it with a stable production profile for decades. With a forward PER of roughly 39.3x, the market is pricing it as a growth stock. Its strategic importance to the US supply chain cannot be overstated, making it a primary target for institutional investors who want direct exposure to the copper rally without the complexities of smaller, more speculative miners.

3.2 Southern Copper (SCCO): The Low-Cost Moat and Dividend Yield

Southern Copper, trading at $170.60, is the preferred choice for those seeking stability and income. With a forward PER of 36.4x and some of the lowest production costs in the world, SCCO can remain highly profitable even if copper prices were to undergo a temporary correction. For an investor like Sarah, SCCO’s attractive dividend yield provides a ‘pay-to-wait’ mechanism, offering a steady income stream while the long-term super-cycle plays out. The company’s massive reserves in Peru and Mexico are a geopolitical hedge in an era of resource nationalism.

| Ticker | Stock Price (Jan 10) | Fwd PER | Primary Strength | Growth Catalyst |

|---|---|---|---|---|

| FCX | $56.53 | 39.3x | US Strategic Supply; High Liquidity | Indonesian Expansion; Spot Price Leverage |

| SCCO | $170.60 | 36.4x | Lowest Cash Costs Globally; Dividends | Peru Mine Expansion; Long Reserve Life |

| COPX (ETF) | $77.54 | ~22.0x | Global Diversification | Institutional Inflows into Mining Sector |

4. Risk Assessment and the 6-Month Strategic Investment Calendar

Risk is the permanent companion of reward. While the bull case for copper at $13,000 is compelling, we must consider the bear case. A global manufacturing recession or a sudden pivot in US energy policy could lead to a temporary surplus. Furthermore, at these high prices, industrial substitution becomes a threat; manufacturers may attempt to replace copper with aluminum in less critical applications. However, in the realm of high-performance AI and high-voltage grid infrastructure, copper’s conductivity and thermal properties remain virtually irreplaceable. Sarah’s strategy should involve monitoring the global Manufacturing PMI—a reading below 50 would be the first warning sign of a demand slowdown.

4.1 The Bull vs. Bear Scenarios for Year-End 2026

In a Bull scenario, copper reaches $15,000 by December 2026, driven by continued labor unrest in Chile and a faster-than-expected deployment of AI data centers. In a Bear scenario, the price stabilizes around $10,500 as Chinese growth stalls and global interest rates stay ‘higher for longer’ to combat lingering inflation. The current data strongly suggests the Bull scenario is more likely, but maintaining a balanced portfolio with both FCX and SCCO provides a hedge against these varying outcomes.

4.2 The 6-Month Investment ‘D-Day’ Calendar

For investors like Sarah, these dates are critical for navigating the upcoming volatility. These events will serve as the primary signals for adjusting position sizes.

| Upcoming Event | Date | Market Significance |

|---|---|---|

| FCX Q4 Earnings Call | Jan 25, 2026 | Guidance on 2026 production and cost control |

| Global PMI Data Release | Feb 15, 2026 | Verification of real industrial demand strength |

| LME Physical Inventory Audit | March 2026 | Reveals the true extent of the supply squeeze |

| US Infrastructure Summit | May 2026 | Funding updates for grid and EV networks |

| Chile Mining Union Deadline | July 2026 | Risk of massive supply-side labor disruptions |

References

- Bloomberg Intelligence, Copper Market Outlook: The New Energy Backbone, 2026

- Goldman Sachs Commodities Research, The Infrastructure Deficit and Copper’s Super-Cycle, 2025

- JP Morgan Commodities Strategy, Copper Price Forecast Revision, Jan 2026

- Investing.com, Real-time Mining Sector Valuations and Financial Ratios, 2026

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Investing in commodities and mining stocks involves significant risk of capital loss. Please consult with a professional financial advisor before making any investment decisions based on the content provided here.