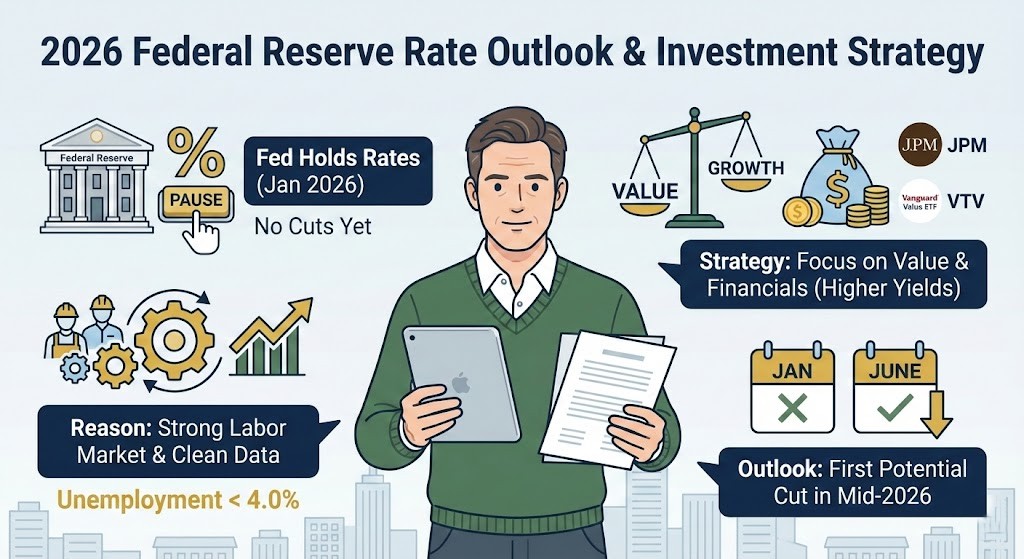

Mark is a 45-year-old project manager in New Jersey who has been diligently contributing to his 401k for two decades. Like many individual investors in early 2026, he expected the Federal Reserve to begin easing its restrictive monetary policy this January to boost market liquidity. However, recent economic indicators and official statements suggest a different reality. As of January 10, 2026, the S&P 500 sits at 6,966.28, reflecting a market that is pricing in economic strength rather than immediate rate relief. Understanding the shift in the Federal Reserve interest rate decision is crucial for investors like Mark who need to rebalance their portfolios for a higher-for-longer environment.

1. The Reality of the Federal Reserve Interest Rate Decision in January 2026

Individual investors often find themselves caught between market optimism and macroeconomic reality. In late 2025, a significant portion of the market bet on a January 2026 rate cut, hoping for a lower cost of capital. However, the Federal Reserve has signaled a firm stance on holding rates steady. Lindsay Rosner, a prominent strategist at Goldman Sachs Asset Management, recently noted that the data following the latest government shutdown has been exceptionally clean and robust. This cleanliness in the data removes the ambiguity that usually allows the Fed to lean toward a more dovish stance. For an investor, this means that the pivot we all expected is being delayed not because of failure, but because of unexpected economic resilience.

1.1 Analysis of the Federal Reserve Pause

The Federal Reserve maintains a dual mandate: price stability and maximum sustainable employment. Currently, the primary driver for keeping the federal funds rate at its elevated level is the lack of visible cracks in the economy. When the data is clean, as Rosner describes, it shows that consumer spending remains stable and corporate earnings in the S&P 500 are meeting or exceeding expectations. This lack of stress in the financial system gives the Fed no incentive to rush into a rate-cutting cycle that could potentially reignite inflationary pressures.

1.2 Impact on Market Volatility and Investor Conviction

Despite the delay in rate cuts, the market is currently characterized by low volatility and low conviction. This sounds like a paradox, but it simply means that while investors aren’t panicked, they are also not entirely sure where the next leg of growth will come from. Institutional flows suggest a rotation out of speculative growth sectors and into high-quality value stocks that can thrive without the crutch of cheap money. To monitor these institutional movements in real-time, professional investors often utilize advanced order flow analytics tools to see where the smart money is positioning itself before the next Fed meeting.

| Analysis Item | Previous Market Trend | Expected Shift in 2026 | Actionable Strategy |

|---|---|---|---|

| Interest Rate Path | Expectation of January Cut | Hold until Mid-2026 | Prioritize Cash Flow Stocks |

| Labor Market | Fear of Sudden Cooling | Sustained Resilience | Focus on Consumer Staples |

| Market Sentiment | High Volatility Speculation | Low Volatility Consolidation | Utilize Covered Call ETFs |

2. Why Strong Labor Markets Prevent Immediate Rate Cuts

The transition from focusing on inflation to focusing on the labor market is a critical theme for 2026. For years, the market hung on every Consumer Price Index (CPI) release. Now, the Federal Reserve is paying closer attention to the unemployment rate and payroll numbers. As long as the unemployment rate stays below the 4.0% threshold, the pressure to cut rates for ‘insurance’ purposes remains low. The Fed is essentially waiting for the labor market to show signs of normalization before they feel comfortable reducing the cost of borrowing.

2.1 The Labor Market Value Chain

The labor market sits at the start of the economic value chain. Strong employment leads to higher wage growth, which fuels consumer spending, accounting for nearly 70% of the US GDP. This spending, in turn, supports corporate revenues and prevents the kind of economic slowdown that would necessitate a rate cut. However, for companies, this means higher input costs (wages), which pressures profit margins. Therefore, the winners in this environment are companies with high pricing power that can pass these costs onto consumers without losing market share.

2.2 Macroeconomic Consequences of Full Employment

Full employment is generally a positive sign, but for the Federal Reserve, it represents a risk of a wage-price spiral. If the Fed cuts rates while the labor market is still this tight, they risk a second wave of inflation, similar to what was seen in the late 1970s. This historical context is why the Fed is being so deliberate. They would rather keep rates high for a few months too long than cut too early and lose their hard-earned credibility on inflation control.

3. Investment Strategy for a High Interest Rate Environment

In a higher-for-longer interest rate environment, the traditional 60/40 portfolio faces unique challenges. Fixed income yields are attractive, but equity selection becomes more rigorous. Financial institutions, particularly large-cap banks like JPMorgan Chase (JPM), stand to benefit significantly. Higher rates allow these banks to maintain wider Net Interest Margins (NIM), the difference between what they earn on loans and what they pay on deposits. As of January 2026, JPM trades at a P/E ratio of 16.3x, which is historically reasonable given its return on equity.

3.1 Peer Group and Valuation Comparison

When comparing JPMorgan to its peers like Goldman Sachs or Bank of America, it becomes clear that quality is being rewarded with a premium valuation. However, compared to the broader tech-heavy Nasdaq, the financial sector remains undervalued relative to its cash flow generation. Investors are increasingly looking at the Vanguard Value ETF (VTV) as a way to capture this rotation into undervalued, high-yielding assets that are less sensitive to interest rate fluctuations than high-growth tech stocks.

3.2 Industry Value Chain and Sector Issues

The financial value chain starts with the Federal Reserve’s policy, which dictates the base cost of money. This flows into commercial banks (JPM, KB Financial), which then distribute capital to the real economy. Currently, the ‘mid-stream’ of this chain—the regional banks—faces some pressure due to commercial real estate exposure. However, the ‘top-stream’ mega-banks are seeing increased deposits as customers seek safety and yield. This divergence creates a ‘winner-take-all’ dynamic where the largest institutions consolidate their market power.

| Metric | JPMorgan (JPM) | Vanguard Value (VTV) | KB Financial (105560) |

|---|---|---|---|

| Current Price | $329.19 | $178.45 | 126,300 KRW |

| P/E Ratio (TMM) | 16.3x | 15.8x | 8.2x |

| Dividend Yield | 1.82% | 2.45% | 2.82% |

| Market Positioning | Global Leader | Broad Value Exposure | Regional Growth/Yield |

4. Strategic Outlook and Major Market Events for the First Half of 2026

The outlook for the next six months requires a balanced perspective. On the positive side (Bull Case), the economy could continue to grow at a moderate pace, allowing corporate earnings to catch up with valuations even without rate cuts. On the negative side (Bear Case), the delayed impact of high rates could finally trigger a sharper slowdown in consumer spending, leading to a harder landing than currently anticipated by the market. Navigating this requires keeping a close eye on the D-Day calendar for upcoming economic releases and Fed meetings.

4.1 Bull vs. Bear Case Scenarios

In the Bull Case, the Fed achieves a ‘perfect soft landing,’ where inflation settles at 2% while growth remains at 2%. In this scenario, the S&P 500 could reach 7,500 by year-end as the mid-year rate cuts provide a fresh tailwind. In the Bear Case, sticky service inflation forces the Fed to hold rates through all of 2026, causing a contraction in multiples for high-growth stocks and a potential 10-15% correction in the broader indices. Diversification into non-correlated assets or high-dividend value stocks acts as a vital hedge in the latter scenario.

4.2 Key D-Day Calendar for Investors (Jan – June 2026)

The following table outlines the critical dates that will dictate market direction over the next two quarters. These events are the ‘triggers’ that will either confirm the current consensus or force a drastic re-evaluation of the investment landscape.

| Event Date | Event Name | Market Significance | Expected Action |

|---|---|---|---|

| Jan 28, 2026 | FOMC Meeting | Rate Decision & Statement | Confirmed Hold / Hawkish Tone |

| Feb 13, 2026 | January CPI Release | Inflation Trajectory | Monitoring Service Inflation |

| Mar 18, 2026 | FOMC Dot Plot | Future Rate Projections | Adjustment of 2026 Cut Count |

| May 06, 2026 | Q1 Earnings Peak | Corporate Health Check | Focus on Margin Sustainability |

| June 17, 2026 | FOMC Meeting | First Potential Rate Cut | High Probability of 25bp Cut |

References

- Bloomberg News, ‘Lindsay Rosner on Fed Policy and Market Outlook,’ 2026.

- Goldman Sachs Global Investment Research, ‘The 2026 Macro Outlook: Transitioning to Stability,’ 2025.

- Federal Reserve Board, ‘Monetary Policy Report to Congress,’ January 2026.

- Investing.com, ‘Global Stock Market Index and Equity Valuations Data,’ 2026.

Disclaimer

This article is for informational purposes only and does not constitute professional financial advice, investment recommendations, or an offer to buy or sell any securities. Investing in financial markets involves risks, including the potential loss of principal. Past performance is not indicative of future results. Please consult with a qualified financial advisor before making any investment decisions based on the information provided here.