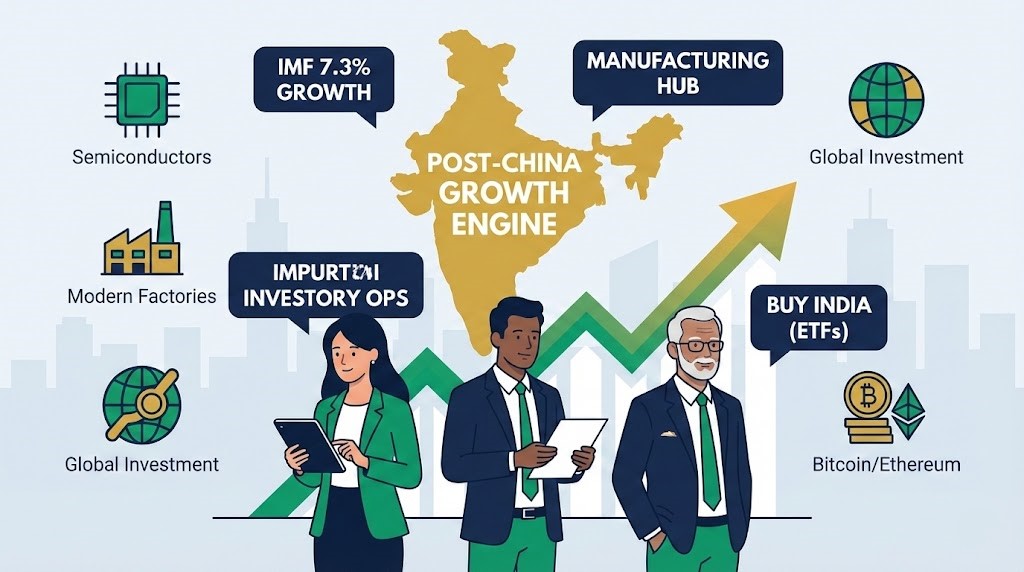

Imagine you are an investor based in Silicon Valley, watching the S&P 500 hit resistance levels while wondering where the next decade of double-digit growth will come from. You have heard the buzz about emerging markets, but the headlines are conflicting. Just this morning, January 19, 2026, the IMF dropped a bombshell: India’s growth forecast has been revised upward to 7.3%, significantly outpacing China’s sub-5% trajectory. This isn’t just a statistic; it is a signal of a structural rotation in global capital. While Mark Mobius has been vocal about increasing his allocation to 30%, the real question for retail investors is whether this rally has legs or if it is another false dawn.

1. Structural Divergence: Why Capital is Leaving China for India

For the past two decades, the global investment thesis for emerging markets was simple: buy China. However, the data we are seeing in early 2026 suggests that this narrative has fundamentally broken. The divergence is no longer just a prediction; it is appearing in hard economic output.

1.1 The Demographic Dividend is Finally Paying Out

The most compelling argument for India is not found in government speeches but in the census data. While East Asian economies grapple with shrinking workforces, India is entering its prime. The median age in India is currently 28.4 years, compared to 39 years in China and 48 years in Japan. This implies a massive runway for domestic consumption. When you have a workforce that is expanding, you naturally see an increase in savings rates and consumption power, which fuels corporate earnings without the need for excessive government stimulus.

1.2 IMF Forecast Update and Macro Implications

The International Monetary Fund’s decision today to upgrade India’s GDP growth forecast to 7.3% for the fiscal year 2025-2026 is a validation of the structural reforms undertaken over the last five years. Unlike the debt-fueled infrastructure growth seen elsewhere, this growth is being driven by capital expenditure (Capex) and a resurgence in private consumption. For the rational investor, this signals that the underlying economy is robust enough to withstand global interest rate volatility.

| Metric | China (The Previous Leader) | India (The Current Challenger) | Investment Implication |

|---|---|---|---|

| GDP Growth (2026 Est.) | 4.6% (Decelerating) | 7.3% (Accelerating) | Capital flows favor higher growth momentum. |

| Working Age Population | Peaked in 2014, Shrinking | Rising, Peak expected in 2040s | Long-term consumption support for India. |

| Supply Chain Role | Mature, Moving up value chain | Rapidly expanding (China + 1) | India is the primary beneficiary of diversification. |

2. The Manufacturing Pivot: From Service Hub to Global Factory

A common criticism of the Indian economy has been its reliance on IT services and outsourcing. While Infosys and TCS remain giants, the real story in 2026 is the tangible shift toward hardware manufacturing. This is the “Make in India” initiative transitioning from a slogan to a reality visible in export data.

2.1 The Apple Effect and Semiconductor Ambitions

By the end of 2025, India accounted for nearly 18% of global iPhone production, a figure that was negligible just five years ago. This is not just about assembly; it is about the ecosystem. The Production Linked Incentive (PLI) schemes have successfully attracted heavyweights like Micron Technology to set up semiconductor assembly and test units. When global giants commit billions in Capex, they are effectively locking in their presence for decades. For investors, this means the industrial sector in India is no longer a value trap but a growth engine.

2.2 Infrastructure: The Silent Enabler

Logistics costs in India were historically prohibitively high, often accounting for 14% of GDP. With the completion of dedicated freight corridors and massive highway expansion, these costs are trending down toward single digits. This efficiency gain translates directly to the bottom line of manufacturing companies, improving their return on equity (ROE). We are seeing cement, steel, and power companies reporting record order books as a result.

| Sector | Traditional View | 2026 Reality | Actionable Insight |

|---|---|---|---|

| Electronics | Net Importer | Emerging Net Exporter | Look for component suppliers and logistics firms. |

| Banking | Struggling with Bad Loans (NPA) | Clean Balance Sheets & High Credit Growth | Private banks are trading at attractive PEG ratios. |

| Energy | Coal Dependent | Aggressive Green Transition | Renewable energy conglomerates are high-growth plays. |

3. Investment Vehicles: ETFs and ADRs for US Investors

Direct access to the Mumbai Stock Exchange (BSE/NSE) is difficult for retail investors abroad. However, the US market offers liquid and efficient vehicles to gain exposure. The key is to avoid “diworsification”—buying bad assets along with the good ones.

3.1 The Broad Market Approach (ETFs)

For most investors, the iShares MSCI India ETF (INDA) remains the primary liquidity vehicle. It covers the large-cap universe effectively. However, for those seeking to avoid state-owned enterprises which often suffer from inefficiencies, the WisdomTree India Earnings Fund (EPI) offers a fundamental-weighted approach. EPI tends to have higher exposure to energy and materials, which are currently benefiting from the infrastructure cycle, giving it a lower P/E ratio compared to the broader index.

3.2 High-Conviction Individual ADRs

If you prefer stock picking, HDFC Bank (HDB) is the titan of the private banking sector. Following its massive merger, it has digested the integration costs and is poised to benefit from the retail credit boom. Another notable name is Infosys (INFY). While IT services have slowed globally, Indian IT is pivoting to AI implementation services, providing a steady cash flow defensive play in your portfolio.

4. Risks and Valuations: Is the Market Overheated?

No investment thesis is complete without a look at the bear case. India has historically traded at a premium to other emerging markets, often dubbed the “India Premium.”

4.1 The Valuation Debate

Currently, the Nifty 50 trades at a forward P/E of approximately 22.4x. While this is expensive compared to China’s 10x or Brazil’s 8x, quality rarely comes cheap. The question is whether earnings growth can justify the multiple. With corporate earnings growing at a CAGR of 15-18%, the PEG ratio (Price/Earnings-to-Growth) remains close to 1.3, which is reasonable for a high-growth market. We are not in bubble territory yet, but we are certainly not in a bargain basement.

4.2 The Bureaucracy and Geopolitics

Despite reforms, land acquisition and contract enforcement remain challenging in India. Furthermore, while India benefits from US-China tensions, any change in US trade policy under a new administration could impact tariffs on Indian exports. Investors must remain vigilant about the upcoming Union Budget in February, as populist spending could derail fiscal discipline.

References

- International Monetary Fund (IMF), “World Economic Outlook Update”, January 2026.

- Bloomberg News, “Interview with Mark Mobius on Emerging Markets”, January 16, 2026.

- Ministry of Commerce and Industry (India), “Export Data & PLI Scheme Progress Report”, December 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial advice, an offer to sell, or a solicitation of an offer to buy any securities. All investments involve risk, including the loss of principal. Please consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.