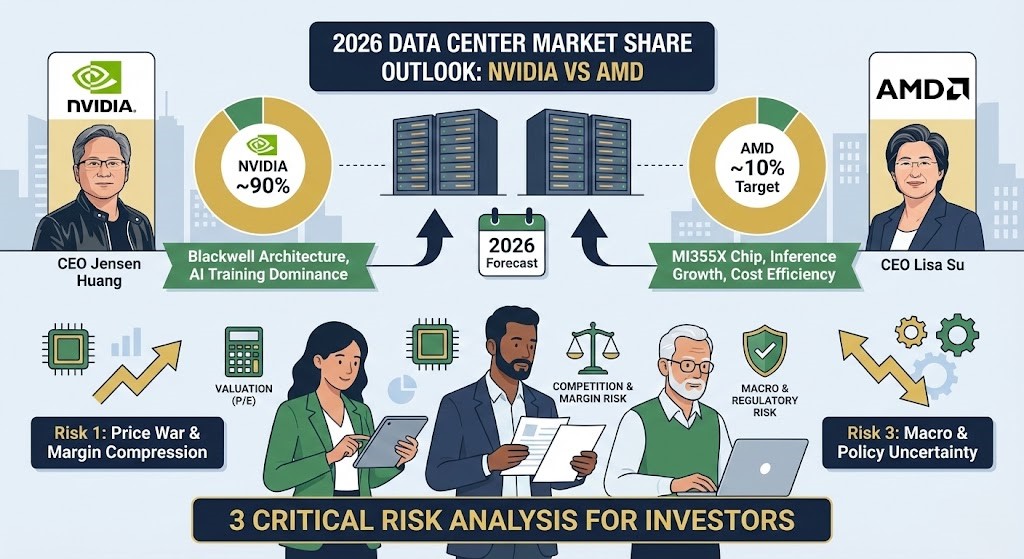

In the landscape of Institutional Asset Allocation, the strategic shift towards AI infrastructure involves rigorous Enterprise Risk Management. As we approach 2026, Asset Allocation models are re-evaluating the semiconductor duopoly.

1. Industrial Map: Blackwell vs MI355X Review

The semiconductor landscape is witnessing a pivotal shift. While NVIDIA has historically commanded a near-monopoly with 80-90% market share in data center GPUs, AMD is aggressively encroaching on this territory with its MI350 and MI355X series. The battle is no longer just about raw speed; it is about memory bandwidth and Total Cost of Ownership (TCO) for hyperscalers.

NVIDIA’s Blackwell architecture remains the gold standard for training massive models, leveraging its CUDA moat which binds developers to its ecosystem. However, AMD’s MI355X, boasting 288GB of HBM3e memory, offers a compelling alternative for “Inference” workloads—the phase where AI models answer queries rather than learning new data. This technical nuance is where the market share war of 2026 will be fought.

2. Data Analysis: Risk & Return Forecast

(Table: Valuation Metrics & Macro Indicators as of Late 2025)

| Metric / Analysis | NVIDIA (NVDA) | AMD (AMD) | Strategic Implication |

|---|---|---|---|

| Forward P/E Ratio | ~24.5x – 46x (Normalized) | ~57x (High Growth Premium) | AMD is priced for perfection; NVDA shows relative value despite size. |

| 2026 Revenue Outlook | Targeting ~$206B | Targeting ~$46B+ | NVDA drives volume; AMD drives growth rate acceleration. |

| Market Share Trend | Dominant but saturating | Targeting 7-10% share | Small share gains for AMD equal massive revenue jumps. |

| Downside Risk | Regulatory & Antitrust probes | Execution failure in software (ROCm) | Monitor regulatory news vs software updates monthly. |

3. Best Investment Roadmap: 2026 Strategy

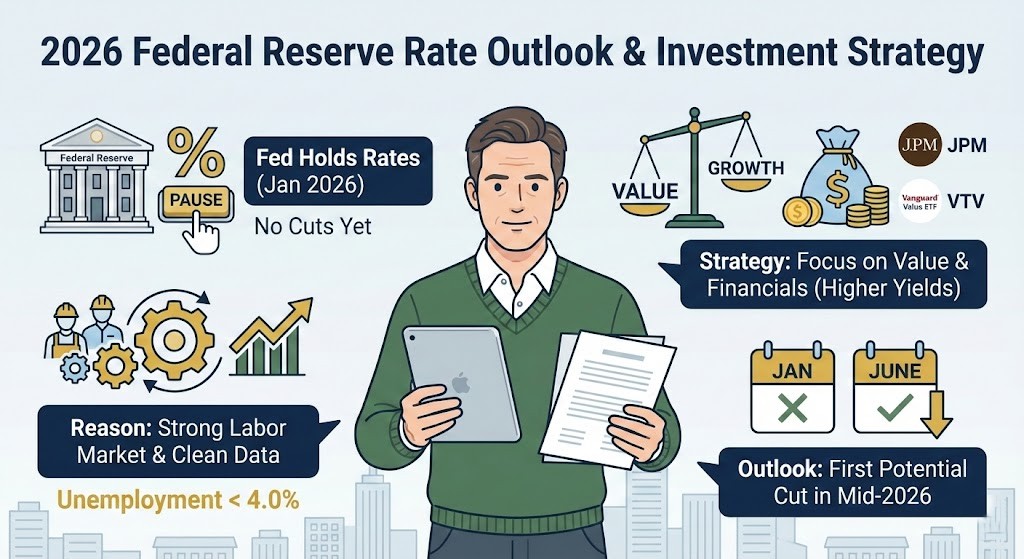

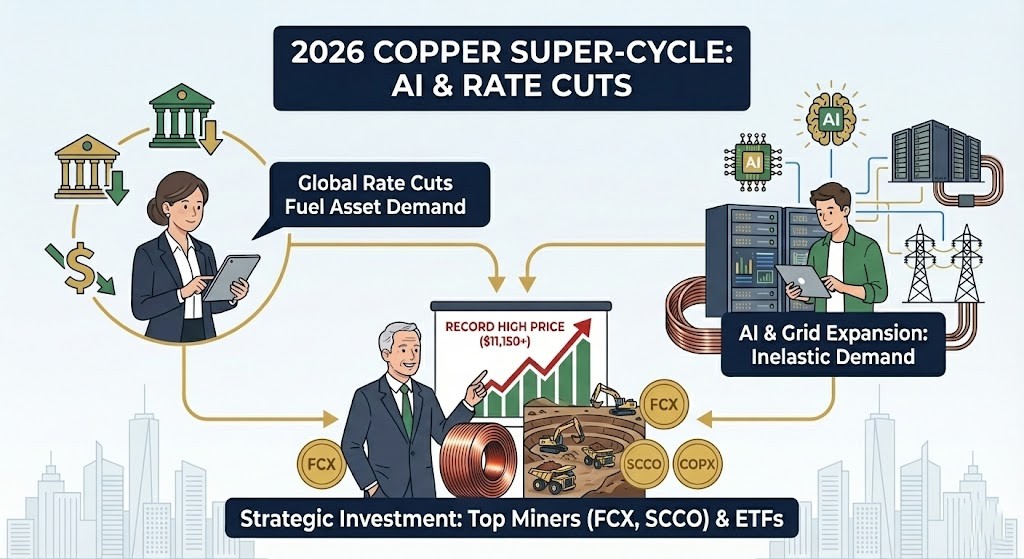

Smart capital does not chase hype; it follows data. With the US Federal Reserve cutting rates to the ~3.5% range in late 2025, liquidity is returning to growth sectors. However, inflation remains sticky at 2.7%, suggesting volatility ahead.

- Short-Term (Q1 2026): Monitor the adoption rate of AMD’s MI355X in cloud providers like Microsoft or Oracle. If backlog grows, AMD offers higher beta upside.

- Mid-Term (Q2-Q3 2026): Watch NVIDIA’s gross margins. If they dip below 74% due to pricing pressure from AMD, re-evaluate positions.

- Long-Term Strategy: Use Professional Portfolio Management Tools to balance exposure. A 70:30 split favoring the leader (NVIDIA) while hedging with the challenger (AMD) is a prudent institutional approach.

Sources & References

- Winvesta & Motley Fool Forecasts 2026

- NASDAQ & Morningstar Financial Data (Dec 2025)

- Federal Reserve FOMC Projections (Dec 2025)

- AMD Official MI350 Series Specs

Disclaimer

This content is for educational purposes only and does not constitute financial advice. Investment in semiconductors involves high risks including capital loss. Please consult a qualified financial advisor before making decisions.