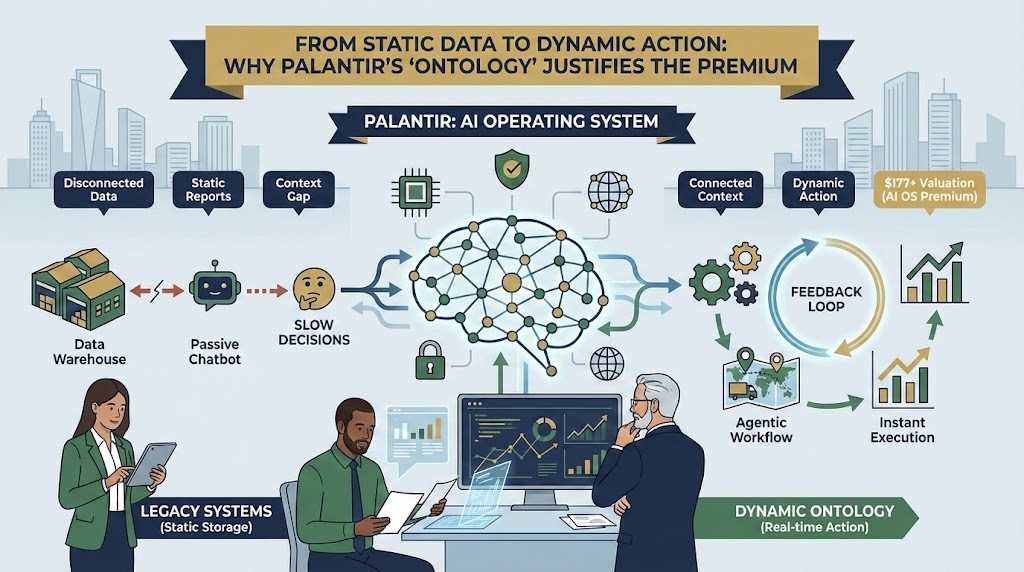

Imagine Sarah, a seasoned logistics manager at a mid-sized automotive manufacturing firm in Ohio. It is January 2026. She has access to the latest LLMs, sophisticated dashboards, and a budget that her predecessor could only dream of. Yet, she is paralyzed. A supplier in Vietnam has just announced a two-week delay due to a localized flood, and simultaneously, a labor strike is looming at a critical port in Los Angeles. Her “AI Assistant”—a generic chatbot integrated into her email—can politely draft an apology letter to customers or summarize the news about the strike. But it cannot answer the one question that matters: “If I reroute the cargo to Vancouver today, how will that impact our EBITDA next quarter compared to paying the overtime wages to expedite production in Mexico?” This is the reality for most businesses in 2026: they have purchased “intelligence” in the form of LLMs, but they lack the “nervous system” to apply it to complex, interconnected decisions. While the market gasps at Palantir’s stock price hovering around $177 and a Price-to-Earnings (PE) ratio exceeding 400, a deeper, second-level analysis reveals that Wall Street is no longer valuing Palantir as a mere software company. They are pricing it as the world’s first true Operating System for the modern AI-driven enterprise—a layer that connects static data to dynamic action.

1. The End of the “Trade-off” Myth: Security vs. Privacy

For decades, decision-makers and IT architects have been trapped in a binary mindset. We collectively believed in a zero-sum game: to increase security, we must sacrifice privacy. To boost efficiency, we must risk resilience. To democratize data access, we must compromise governance. This “trade-off” mentality has defined legacy IT systems, where data is siloed in rigid warehouses to keep it safe, or dumped into chaotic data lakes to make it accessible.

1.1 The Lesson from 9/11 and the Immune System

To understand Palantir’s unparalleled dominance in 2026, we must look back to its philosophical origins post-9/11. The prevailing dilemma of that era was: “Do we inspect everyone’s data to stop terror (sacrificing privacy), or do we protect privacy and risk security?” Palantir’s foundational thesis was that this trade-off is false. They posited that with the right architecture, you can enhance security and privacy simultaneously. This is analogous to the human immune system. We often take vitamins to boost immunity, yet our bodies naturally produce cortisol, which suppresses immunity to prevent autoimmune diseases. Are these biological functions fighting each other? No. They are engaged in a dynamic feedback loop to maintain homeostasis (balance). A fever is good for fighting infection but fatal if prolonged. The body manages this context perfectly through real-time signaling. Most enterprise software, however, sees only the fever or only the vitamin. Palantir sees the whole body.

1.2 From Static Logs to Dynamic Feedback Loops

The reason Palantir has separated itself from the pack—leaving competitors like Snowflake and Databricks to fight over storage commoditization—is its mastery of the “Feedback Loop.” In traditional systems (like the early generations of SAP or Salesforce), data entry is a graveyard. You input a customer interaction, and it stays there, static, waiting to be queried. In Palantir’s **Dynamic Ontology**, every data point is a trigger. If a logistics officer reroutes a ship in the software, that action doesn’t just update a database row; it instantly recalculates the financial margin for the CFO, updates the inventory forecast for the warehouse manager, and alerts the legal team about potential compliance risks across borders. This is not just data integration; it is a digital twin of the organization’s decision-making logic. The system learns from every interaction, creating a compounding advantage (Write-Back mechanism) that static data lakes cannot replicate. The Ontology essentially turns the company’s operations into a programmable object.

| Feature | Legacy Data Platforms (Snowflake/Databricks) | Palantir (AIP & Foundry) | Implication for Investors |

|---|---|---|---|

| Data State | Static Storage (Read-Only focus) | Dynamic Action (Read/Write/Execute) | Palantir commands a premium for “doing,” not just “storing.” |

| AI Role | Chatbot / Summarization / Code Assist | Agentic Workflow / Operational Execution | Higher stickiness and pricing power; difficult to rip out. |

| Integration Logic | Requires heavy engineering to connect silos | Pre-built connectors (Ontology) for decision context | Palantir deploys faster in crises (e.g., wars, supply shocks). |

2. Why Chatbots Don’t Solve Real Problems: The Context Gap

The initial euphoria around Generative AI in 2023-2024 has settled into a phase of disillusionment for many Global 2000 companies. They realized that an LLM (Large Language Model) is like a brilliant new hire who has read every book in the Library of Congress but doesn’t know where the company restrooms are or who approves budget requests over $50,000.

2.1 The “Context Gap” and Hallucinations

This is what we call the “Context Gap.” An AI can write a Python script or a poem in the style of Shakespeare, but it cannot navigate the complex, unwritten rules and real-time constraints of a specific corporation unless it is grounded in that corporation’s reality. Without an Ontology, LLMs hallucinate or provide generic advice. Palantir’s AIP (Artificial Intelligence Platform) acts as the connective tissue. It feeds the LLM the “Ontology”—the real-time state of the business, its constraints, and its logic. This allows the AI to transition from a passive chatbot to an active “Agent” that can perform tasks. For instance, instead of just saying “Inventory is low,” an AIP Agent can say, “Inventory is low at the Texas plant. I have drafted a purchase order for supplier B because Supplier A is facing delays, and this fits within your Q1 budget. Click to approve.” This is why Palantir’s US Commercial revenue has exploded by 121% year-over-year. Companies are not buying software; they are buying an infrastructure that makes their massive AI hardware investments actually yield a return.

2.2 The Moat of “Accumulated Complexity”

Critics often argue that big tech giants will simply replicate this. “Why can’t Microsoft just build an Ontology?” However, building an Ontology is not a coding challenge; it is an operational one. It requires 20 years of experience in the trenches—literally in war zones, disaster relief efforts, and anti-fraud investigations—to understand how to model the messiness of the real world. While competitors were building better databases to store structured tables, Palantir was building systems to model terrorism networks, pandemic supply chains, and manufacturing lines. This “accumulated complexity” is a moat that is nearly impossible to cross overnight. As noted by industry experts, the next trillion-dollar platform will not be the one that hosts the data, but the one that captures the dynamic context of decision-making.

| Metric | Palantir (PLTR) | Snowflake (SNOW) | Datadog (DDOG) |

|---|---|---|---|

| Market Cap (Jan 2026) | ~$427 Billion | ~$72 Billion | ~$55 Billion |

| PER (TTM) | ~407x | N/A (Profitability issues) | ~55x |

| Core Narrative | AI Operating System (OS) | Data Cloud / Storage | Observability / Monitoring |

3. Valuation Analysis: Is a 400x PE Ratio a Bubble?

At a price of ~$177 and a PE ratio of over 400, Palantir is undeniably expensive by traditional metrics. Value investors adhering to Graham and Dodd principles would likely look at this chart and scream “Sell.” However, market participants are pricing PLTR not on trailing earnings, but on its potential to capture a significant fraction of the global labor market’s value.

3.1 The “Digital Labor” Valuation Model

When a company deploys Palantir AIP, they are often looking to automate complex cognitive tasks that previously required expensive human analysts. If Palantir charges $10 million for a system that replaces or augments $50 million worth of human labor inefficiency, the traditional software margins don’t apply. We are witnessing a shift from Software-as-a-Service (SaaS) to **Service-as-a-Software**. If Palantir is indeed the operating system for the entire AI economy, a 400x multiple might be akin to Amazon’s high multiples in the early 2010s—high relative to current profits, but low relative to future dominance. The market is betting that Palantir is capturing the “Labor Budget” (trillions of dollars) rather than just the “IT Budget” (billions of dollars).

3.2 Risk Factors: The “Perfect 100” Scenario

However, the stock is “priced for perfection.” The market assumes that US Commercial growth will remain above 50-60% for years and that government contracts will continue to expand without friction. Any slip in execution, or any macroeconomic shock that reduces corporate IT spending, could lead to a sharp correction. If growth slows to even 30%, the multiple could compress rapidly, halving the stock price. The volatility is a feature, not a bug, of owning a company that is creating a new category. Investors must ask themselves: Am I investing in a software vendor, or am I hedging against the disruption of my own industry?

| Scenario | Bull Case (Optimistic) | Bear Case (Pessimistic) | Strategic Pivot |

|---|---|---|---|

| Thesis | AIP becomes the standard OS for Global 2000 companies. | Competition catches up; AI adoption slows down due to cost. | Monitor US Commercial Growth % closely. |

| Target Price | $250+ (12mo) | $90 – $110 (Correction) | Accumulate on dips >15%. |

| Key Driver | Massive adoption of AI Agents replacing white-collar tasks. | Valuation compression due to high interest rates. | Focus on net retention rates (NDR). |

4. Strategic Allocation in a High-Volatility Era

For the individual investor, the fear of missing out (FOMO) battles with the fear of heights. Buying at all-time highs is psychologically difficult. However, history shows that winners tend to keep winning because they have the capital and talent to reinforce their lead. The strategy here is not to go “all in” at $177, but to recognize that this is a long-term secular trend.

4.1 The “Barbell” Approach

Consider a barbell strategy. On one side, hold stable, cash-generating assets (like short-term Treasuries or high-dividend aristocrats). On the other, hold high-growth disruptors like Palantir. Do not treat PLTR as a trade; treat it as a venture capital investment that has already gone public. The liquidity allows you to enter and exit, but the mindset should be multi-year holding. If the thesis of the “Dynamic Ontology” holds true, Palantir is building the digital infrastructure for the 21st century, much like railways were for the 19th.

4.2 Upcoming D-Day: Q4 Earnings

The immediate catalyst to watch is the upcoming earnings report in early February. The market will look past the revenue beat; the real signal will be the guidance for 2026. If management signals an acceleration in AIP bootcamps converting to large enterprise contracts, the rally may have legs. If there is hesitation, expect a sharp pullback, which should be viewed as a buying opportunity for the prepared investor. The key metric to watch is the “Customer Count” growth in the US Commercial sector—if this slows, the thesis weakens.

References

- Palantir Technologies Inc., “Q3 2025 Earnings Presentation & 10-Q”, 2025.

- BigDataDoctor, “The True Competitiveness of Palantir: The Origin of Ontology”, YouTube Analysis, 2026.

- Zacks Investment Research, “Palantir Technologies (PLTR) Stock Research Report”, Jan 2026.

- Investing.com, “Real-time Market Data: PLTR, SNOW, DDOG”, Jan 18, 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial advice, an offer to sell, or a solicitation of an offer to buy any securities. All investments involve risk, including the loss of principal. Please consult with a qualified financial advisor before making any investment decisions. The author may hold positions in the securities mentioned.