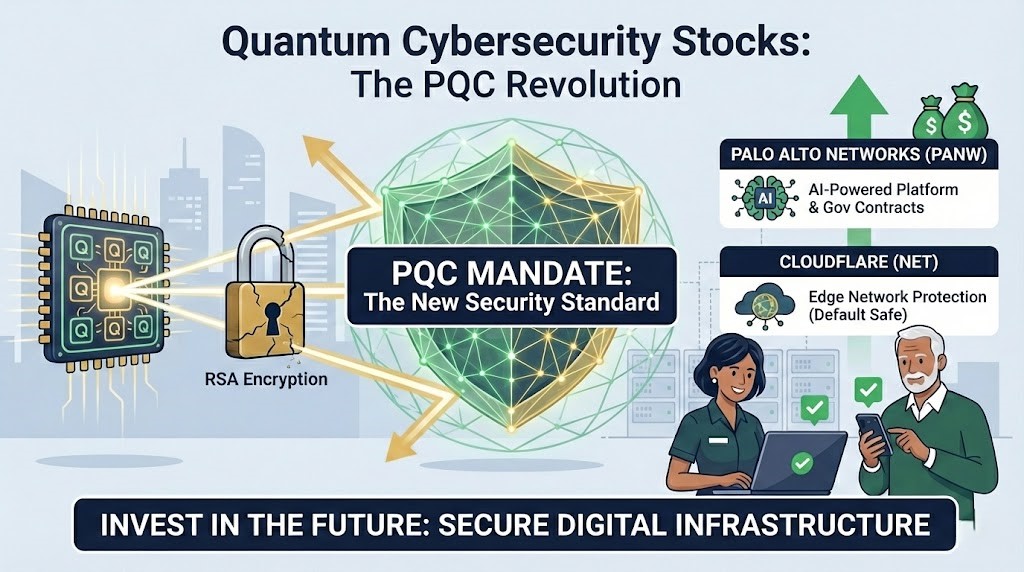

Imagine waking up to a world where every encrypted password, bank record, and government secret is suddenly transparent. For many retirees and tech-focused office workers, this isn’t a sci-fi plot but a pressing financial reality as we enter 2026. With the U.S. government officially mandating Post-Quantum Cryptography (PQC) standards this year, the cybersecurity landscape is undergoing its most significant shift since the invention of the internet. Companies like Palo Alto Networks are no longer just ‘firewall providers’; they are becoming the essential guardians of the quantum era.

1. The Hidden Vulnerability in Your Digital Wealth

Many individual investors feel a sense of security when they see the ‘lock’ icon on their browser. However, the rise of quantum computing threatens to shatter this illusion. If you are a mid-career professional worried about the long-term safety of your digital assets, understanding the ‘Harvest Now, Decrypt Later’ threat is crucial. Malicious actors are already stealing encrypted data today, waiting for the moment a quantum computer can unlock it. This urgency is driving a massive wave of infrastructure spending that most retail investors are still overlooking.

1.1 The Expiration Date of Traditional Encryption

Current encryption methods like RSA rely on the difficulty of factoring large prime numbers—a task easy for a quantum computer but impossible for today’s machines. As NIST (National Institute of Standards and Technology) finalizes the transition to PQC, the old guard of security is being replaced by complex lattice-based mathematics that even quantum bits cannot penetrate.

1.2 The Shift from Awareness to Mandatory Adoption

2026 marks the year when ‘should’ becomes ‘must.’ Federal agencies and critical infrastructure providers are now legally required to begin their PQC migration. This regulatory tailwind is creating a non-discretionary spending cycle, making certain cybersecurity firms exceptionally resilient to broader economic downturns.

| Analysis Item | Past Security Landscape | The 2026 Transformation | Action Strategy |

|---|---|---|---|

| Primary Threat | Classical Phishing & Malware | Quantum-Enabled Decryption | Focus on PQC-ready vendors |

| Regulatory Status | Optional Best Practices | Mandatory Federal Compliance | Identify government contractors |

| Market Leader | Traditional Firewall Firms | AI-Driven Quantum Platforms | Monitor Palo Alto & Cloudflare |

2. Why 2026 Is the Tipping Point for Cybersecurity Stocks

The transition to PQC is not a simple software patch; it requires a complete overhaul of how data is handled across the globe. This creates a multi-billion dollar replacement cycle. For the average employee contributing to a 401(k), this represents a rare ‘super-cycle’ in the tech sector. The demand for PQC integration is surging across banking, healthcare, and defense, providing a clear ‘moat’ for companies with established trust and advanced R&D.

2.1 The Convergence of AI and Quantum Security

Modern security isn’t just about the math; it’s about the speed of detection. Leading firms are integrating ‘Precision AI’ to monitor for quantum-related anomalies in real-time. This synergy between AI and PQC is the new gold standard for institutional investors.

2.2 Valuation Gap: Real Value vs. Hype

While some quantum hardware stocks are purely speculative, the software and service providers are generating real cash flow. We are seeing a shift where high-PER companies are being justified by their 30% plus annual recurring revenue (ARR) growth in the PQC segment.

3. Deep Dive: Leading Guardians of the Quantum Era

When looking at the competitive landscape, two names stand out for their aggressive PQC roadmaps. To check the real-time institutional flow for these stocks, investors should utilize professional-grade market intelligence tools that track government contract wins.

3.1 Palo Alto Networks (PANW): The Platform Play

Palo Alto has successfully transitioned from a hardware-centric model to an AI-first security platform. Their ‘Strata’ and ‘Prisma’ suites now include PQC-ready modules as a standard feature, locking in enterprise customers who cannot afford a security breach in the next decade.

3.2 Cloudflare (NET): The Network Layer Advantage

Cloudflare’s edge network handles a massive portion of the world’s internet traffic. By implementing PQC at the edge, they protect data in transit before it even reaches the customer’s server. This ‘blanket protection’ model makes them a favorite for rapid, large-scale deployment.

| Peer Comparison | Palo Alto (PANW) | Cloudflare (NET) | Thales (HO.PA) |

|---|---|---|---|

| Core Strength | Enterprise Platform | Edge Network Speed | Gov & Defense Hardware |

| PQC Readiness | High (Integrated AI) | Full (Default Active) | High (HSM Modules) |

| Market Focus | Corporate/B2B | SaaS/Web Services | European Gov/Defense |

4. Practical Strategy for the Post-Quantum Transition

For the ‘wisdom-seeking’ investor, the goal isn’t to find the next ‘100x’ penny stock, but to align with the infrastructure that the world cannot function without. The bull case for PQC is a world where security spending becomes as fundamental as electricity. The bear case involves a slower-than-expected hardware rollout, yet even then, the software transition remains inevitable.

4.1 Bull vs. Bear Scenarios

In a Bull Case, PQC adoption accelerates private sector spending by 40% in 2026. In a Bear Case, budget constraints delay the full migration until 2028, leading to short-term volatility but maintaining the long-term upward trajectory as the ‘Quantum Day’ deadline nears.

4.2 The 6-Month D-Day Calendar

Key events to watch include the Q1 earnings calls of PANW and NET, where ‘PQC ARR’ will be a primary focus, and the mid-year NIST progress report which will dictate the next phase of global compliance.

| Event Date | Key Milestone | Impact on Sector |

|---|---|---|

| Feb 2026 | Q4 2025 Earnings Cycle | Validation of PQC revenue growth |

| May 2026 | NIST Compliance Audit | Selection of ‘Preferred Vendors’ |

| July 2026 | G7 Security Summit | Global synchronization of PQC laws |

Reference Sources

- NIST, Post-Quantum Cryptography Standardization Report, 2024

- Morgan Stanley Research, The Cyber-Quantum Super Cycle, 2025

- Bloomberg Intelligence, Cybersecurity Outlook 2026: The PQC Mandate, 2026

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions.