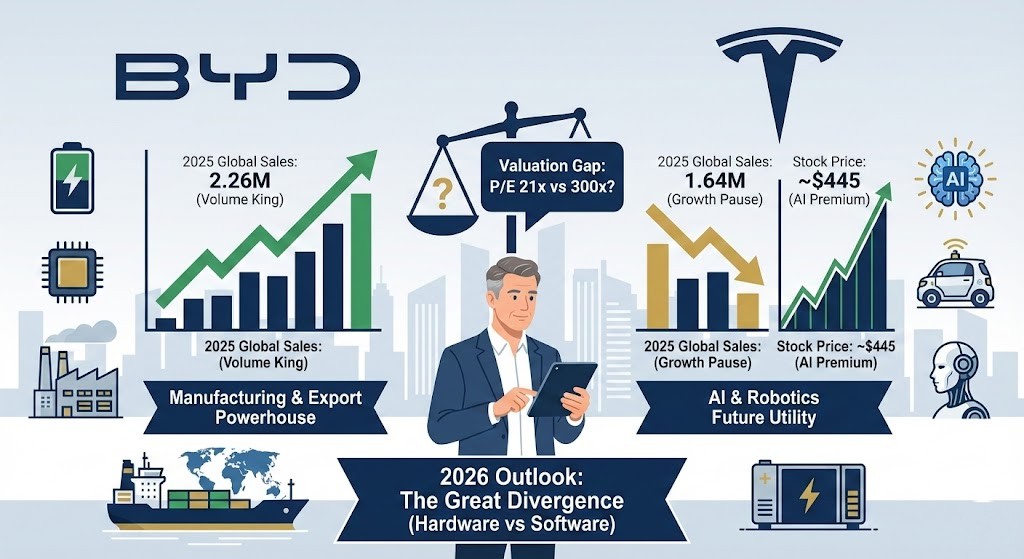

Meet Michael, a 45-year-old systems engineer living in Austin, Texas. He bought Tesla shares back in 2021, believing in the EV revolution. Today, as he checks his portfolio on January 12, 2026, he is confused. The news headlines scream that Chinese rival BYD has officially overtaken Tesla in global sales, leaving Elon Musk’s company with a 9% drop in deliveries. Yet, Tesla stock is trading at a staggering $445.01. Why is the market rewarding a company that is losing market share? Is this a bubble about to burst, or is the market seeing something Michael is missing? In this analysis, we dissect the disconnect between sales volume and stock price, and what the critical year of 2026 holds for your money.

1. The Official Change of the Guard: 2025 Sales Analysis

The debate is officially over. For years, skeptics warned that traditional automakers or new challengers would catch up to Tesla. In 2025, it wasn’t Ford or Toyota that took the crown, but China’s BYD. The data we have finalized as of January 2026 paints a stark picture of the automotive landscape.

1.1 The Hard Numbers: Volume War Results

BYD ended 2025 with 2.26 million battery electric vehicles (BEVs) sold worldwide, completely eclipsing Tesla’s 1.64 million. This is not a margin of error; it is a decisive victory in the volume war. While Tesla struggled with a shrinking lineup and political backlash that alienated some of its core customer base in the US and Europe, BYD capitalized on vertical integration. They make their own batteries, chips, and even ship their cars on their own fleet of vessels. This allowed them to slash prices aggressively while maintaining margins, something Tesla found increasingly difficult to do without hurting its bottom line.

1.2 Why Tesla’s Deliveries Declined

Tesla’s decline to 1.64 million units represents a year-over-year contraction. Several factors contributed to this. First, the removal of federal EV incentives in the US under the new administration hit demand hard. Second, the Model Y and Model 3, despite refreshes, are aging platforms in a market flooded with newer, feature-rich competitors. Third, Elon Musk’s increasing political activity has had a measurable negative impact on brand sentiment among liberal buyers who were once the company’s strongest advocates. Conversely, BYD’s export growth to 1.05 million units shows that their demand is no longer confined to China; they are winning in Southeast Asia, South America, and parts of Europe despite tariffs.

| Metric | Tesla (The Former King) | BYD (The New King) | Implication for Investors |

|---|---|---|---|

| 2025 BEV Sales | 1.64 Million (Declining) | 2.26 Million (Surging) | Growth in pure auto sales has shifted to China. |

| Primary Growth Engine | AI & Robotaxi Promises | Export Markets & Hybrids | Tesla is a tech play; BYD is a manufacturing play. |

| Major Headwind | Aging Lineup & Politics | Tariffs & Geopolitics | Both face macro risks, but of different natures. |

2. The Great Valuation Disconnect: P/E 300x vs 21x

Here lies the most confusing aspect for a rational investor like Michael. If BYD is selling more cars and growing faster, why is Tesla valued at over 300 times its earnings, while BYD languishes at a P/E of around 21? This gap cannot be explained by car sales alone.

2.1 Market Psychology: Manufacturing vs. Software

The market is currently pricing Tesla not as an automaker, but as an AI and Robotics monopoly. At $445.01 per share, investors are paying for the future option of the Cybercab and Optimus robot, not the current reality of Model Y sales. The consensus among bulls is that Tesla’s Full Self-Driving (FSD) data—accumulated from millions of vehicles—creates a moat that no competitor can cross. In contrast, BYD is priced strictly as a hardware manufacturer. The market applies a heavy “China Discount” due to regulatory fears and the lower margins associated with hardware sales compared to software subscriptions.

2.2 The Risk of High Expectations

A P/E ratio of 306.90x implies perfection. It suggests that Tesla’s transition to a high-margin robotaxi fleet is guaranteed. However, this leaves zero room for error. If the technology hits a regulatory wall or if the Cybercab launch in April 2026 is delayed, the valuation compression could be brutal. On the other hand, BYD’s low multiple provides a significant “margin of safety.” Even if their growth slows, the stock is not priced for perfection, offering a potentially safer floor for conservative investors.

| Ticker | Price (Jan 12, 2026) | P/E Ratio | Market Sentiment |

|---|---|---|---|

| TSLA | $445.01 | 306.90x | Priced as a high-growth AI monopoly. High Risk / High Reward. |

| BYD (1211.HK) | HK$94.50 | 21.60x | Priced as a profitable manufacturer with geopolitical risk. Value Play. |

| Hyundai (005380) | ₩375,500 | 8.38x | Priced as a legacy automaker transitioning successfully. Deep Value. |

3. Tesla’s Pivot: From Car Maker to AI Utility

To understand Tesla’s future, you must ignore the car and look at the compute. The company’s narrative has shifted entirely to “Real-World AI.”

3.1 The Robotaxi Gamble

Wall Street analysts have become cautious about Tesla’s automotive growth, with many downgrading their volume estimates. However, they remain bullish on the stock solely due to the Robotaxi thesis. The upcoming dedicated Robotaxi event and production start in early 2026 are the primary catalysts. If Tesla can demonstrate a path to unmonitored autonomous transport, the decline in car sales will be viewed as irrelevant—much like Apple’s iPod sales declining as the iPhone took over.

3.2 Energy and Robotics

Another pillar supporting the $1.5 trillion valuation is Tesla Energy. While auto sales dipped, energy storage deployment has tripled. This segment is growing faster than the automotive business and commands stable margins. Furthermore, the Optimus humanoid robot represents the next frontier. While still in early stages, the market is assigning a non-zero value to the possibility that Tesla will solve the labor shortage crisis in the 2030s. This is why comparing Tesla to BYD solely on car sales is an apples-to-oranges comparison in the eyes of institutional investors.

4. Investment Strategy and Critical Dates in 2026

So, what should an investor do? The answer depends on your belief in AI versus your preference for tangible cash flows.

4.1 Scenario Planning: Bull vs. Bear

If you are an aggressive growth investor, Tesla remains the only viable play with infinite upside potential, provided you can stomach the volatility. The “Bull Case” sees the stock reaching $600+ if FSD gains regulatory approval. The “Bear Case” sees the stock crashing to $150 if the AI promise turns out to be a mirage and they are valued back as a car company. For conservative investors, BYD and Hyundai offer exposure to the electrification trend without the valuation bubble, paying dividends and trading at single or low-double-digit multiples.

4.2 The D-Day Calendar

Investors must mark their calendars for these critical events. The Q4 2025 earnings call on January 28 will reveal the full extent of the margin damage from the sales drop. More importantly, April 2026 is the expected timeline for the Cybercab production updates. Any delay here will be punished severely by the market.

References

- Bloomberg, “Tesla Is Finally Toppled by BYD as EV King”, 2026

- Investing.com, “Real-time Market Data for TSLA, BYD, Hyundai”, Jan 12, 2026

- Zacks Investment Research, “Tesla EV Deliveries Slide in 2025: Analysis”, 2026

- Morningstar, “BYD Company Ltd (1211) Equity Report”, 2026

Disclaimer

This content is for informational purposes only and does not constitute financial advice, an offer to sell, or a solicitation of an offer to buy any securities. All investment involves risk, including the loss of principal. Past performance is not indicative of future results. Please consult with a qualified financial advisor before making any investment decisions.